Find out how this active fund, accessible on the ASX, focuses on the quickly expanding battery and electric car industries. With the growing interest in renewable energy worldwide, investors have a rare chance to support sustainable development while obtaining high profits with the ACDC ETF. Explore our in-depth analysis to discover how ACDC can be a wise addition to your portfolio, seamlessly combining environmental principles with financial objectives.

ACDC ETF Review: Electrify Your Portfolio with a Spark of Innovation

In a world where innovation and sustainability are essential, the ACDC ETF stands out as a wise investment choice. This ETF, which is traded on the ASX, is a venture into the future of energy and transport, not just any old investment vehicle. Given the relentless momentum behind the change to electric vehicles (EVs) and battery technology, the ACDC ETF presents a unique chance to participate in this revolutionary journey. Let’s examine the key components of the ACDC ETF and why it could be the surprisingly profitable investment you’ve been looking for.

What is the ACDC ETF?

It’s essential to comprehend the foundations of what the ACDC ETF stands for before delving into its fascinating universe. Fundamentally, the ACDC ETF is an investment fund listed on the Australian Securities Exchange (ASX) and specifically created to monitor the performance of businesses at the forefront of electric vehicle and battery technology. This strategic focus is a deliberate attempt to capitalise on the industries propelling the transition to a greener, more sustainable future, not an accident.

The ACDC ETF is an investment in the future of our planet, not only in technology. It gives investors the opportunity to make a positive impact on the environment while also possibly reaping large gains by investing in businesses that are leading the transition away from fossil fuels and towards renewable energy sources.

The Spark Behind ACDC (ASX: ACDC)

The ACDC ETF is unique in the investing world not just for what it is but also for what it stands for a direct route into the explosive growth of the renewable energy and electric car industries. The businesses that the ACDC ETF invests in—battery technology, lithium mining, and electric car manufacturing, for example—are not merely emerging markets; they are the front-runners in our transition to a more sustainable and cleaner future. The sectors at the core of ACDC’s portfolio are positioned for substantial growth due to governments throughout the world establishing aggressive carbon neutrality targets and consumers’ growing preference for eco-friendly goods.

Key Features of ACDC ETF

ACDC ETF reveals several characteristics that make it an appealing option for investors. The key component of these traits is a deliberate concentration on the rapidly expanding fields of battery technology and electric vehicles, which are experiencing rapid growth due to the worldwide movement towards sustainability and cleaner energy.

- Diversification: The ACDC ETF’s dedication to diversification is one of its most notable qualities. ACDC reduces risk by investing in a wide range of businesses in various markets and sectors of the electric and renewable energy ecosystem.

- Growth Potential: The ACDC ETF is ideally positioned to benefit from the rapid expansion of the renewable energy and electric vehicle markets, as it sits at the nexus of technology and sustainability.

- Sustainability: ACDC offers investors a sustainable investment option that makes a positive impact on the world by concentrating on industries essential to the worldwide shift towards cleaner energy and transportation solutions. This helps investors connect their portfolios with their values.

These characteristics highlight ACDC ETF as a diversified investment option that provides both the possibility of monetary rewards and the ability to participate in a larger movement towards a future that is more technologically sophisticated and sustainable.

ACDC ETF’s Financial Landscape

A thorough examination of the ACDC ETF’s holdings, performance, and sectoral and geographic distribution reveals a fund firmly rooted in sustainable technology’s future. Together with the fund’s top holdings and sector and country breakdowns, the full performance table, as of March 15, 2024, provides a nuanced picture of the fund’s performance and placement in the quickly changing markets for renewable energy technologies and electric cars (EVs).

Performance Overview

| Performance Table As of 15 Mar 2024 | Total Return (Fund) | Total Return (Benchmark) | Tracking Difference | Tracking Error |

| 1 Month | 3.09% | 3.13% | -0.05% | 0.02% |

| 3 Months | 1.69% | 1.85% | -0.16% | 0.07% |

| 1 Year | 0.51% | 1.29% | -0.78% | 0.17% |

| 3 Year p.a. | 3.70% | 4.56% | -0.86% | 0.25% |

| 5 Year p.a. | 17.12% | 18.13% | -1.01% | 0.37% |

| 10 Year p.a. | — | — | — | — |

| Since Inception p.a. | 14.18% | 15.09% | -0.91% | 0.39% |

Short-term Performance: In a month, the fund returned 3.09%, which was marginally lower than the 3.13% return of its benchmark. This suggests a little tracking error of 0.02% and a slight tracking divergence of -0.05%. This reflects the fund’s flexible investment approach and close alignment with market movements.

Medium-Term Outlook: With a 3-month horizon, the fund’s 1.69% performance compared to the benchmark’s 1.85% shows a 0.07% tracking error and a slight tracking divergence of -0.16%. This time frame demonstrates the fund’s stable handling of market swings.

Yearly Outlook: The discrepancy becomes more noticeable after a year when the fund generated a 0.51% return as opposed to the benchmark’s 1.29% return. This led to a -0.78% tracking difference and a 0.17% tracking inaccuracy. The fund’s strategic focus areas present opportunities and problems, which this gap highlights.

Long-Term Performance: The fund has produced respectable returns over the last three and five years on an annual basis of 3.70% and 17.12%, respectively, albeit both have lagged below their respective benchmarks. These numbers, along with tracking discrepancies of -0.86% and -1.01%, show the fund’s potential for long-term growth in the context of sustainable technology development.

Since Inception: With a tracking difference of -0.91% and a tracking error of 0.39%, the fund has produced an impressive annualised return of 14.18% since launch, marginally less than the benchmark’s 15.09%. This demonstrates the fund’s strong base and flexibility to develop and adapt to worldwide sustainability trends.

Leading Holdings and Industry Analysis

Top Holdings and Sector Insight

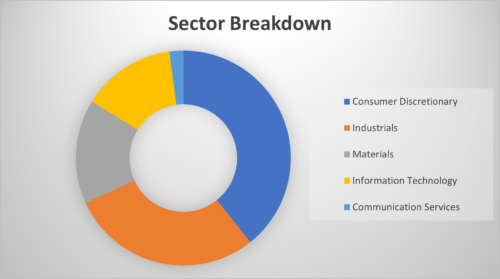

Leading companies, including HD Hyundai Elect, Sumitomo Elec In, and ABB Ltd-Reg, are among the fund’s principal holdings as of March 18, 2024, demonstrating a strategic focus on businesses at the forefront of EV and renewable energy advancements. Information technology, materials, consumer discretionary, and industrials make up the majority of the diversified sectors, which illustrates the fund’s all-encompassing strategy for seizing the growth potential within the sustainable energy ecosystem.

Below is the table for your reference.

| Sector | WEIGHT (%) |

|---|---|

| Consumer Discretionary | 39.6 |

| Industrials | 29.1 |

| Materials | 15.8 |

| Information Technology | 14.2 |

| Communication Services | 2.1 |

| Net Assets (%) | Name | SEDOL | Market Price (Local) | Shares Held | Market Value (A$) |

|---|---|---|---|---|---|

| 6.84 | HD HYUNDAI ELECT | BD4HFR9 | 148,000.00 | 222,828 | 37,734,107 |

| 4.91 | SUMITOMO ELEC IN | 6858708 | 2,266.50 | 1,186,200 | 27,444,372 |

| 4.77 | ABB LTD-REG | 7108899 | 42.4 | 370,755 | 27,083,600 |

| 4.56 | TDK CORP | 6869302 | 7,436.00 | 337,000 | 25,580,495 |

| 4.41 | MERCEDES-BENZ GR | 5529027 | 73.1 | 206,660 | 25,041,233 |

| 4.3 | RENAULT SA | 4712798 | 42.8 | 344,485 | 24,439,707 |

| 4 | HONDA MOTOR CO | 6435145 | 1,782.50 | 1,219,000 | 22,180,580 |

| 3.97 | BMW AG | 5756029 | 105.68 | 128,732 | 22,550,762 |

| 3.78 | VOLKSWAGEN-PREF | 5497168 | 113.78 | 113,916 | 21,484,862 |

| 3.76 | MINERAL RESOURCE | B17ZL56 | 65.91 | 323,084 | 21,294,466 |

Global Allocation

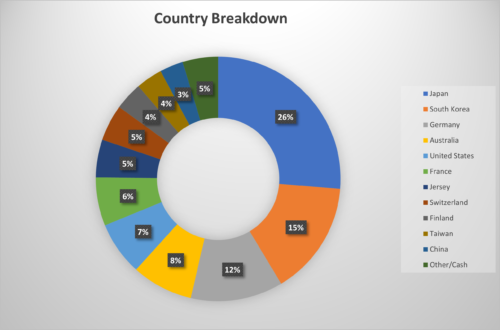

The split of the countries shows a deliberate geographic diversification, with sizeable holdings in Germany, South Korea, Japan, and other countries. This worldwide spread not only reduces risk but also ensures the fund is in an excellent position to gain from new developments and changes in policy that support EV and sustainable energy technologies in many markets.

| COUNTRY | WEIGHT % |

|---|---|

| Japan | 26.3 |

| South Korea | 15.1 |

| Germany | 12.2 |

| Australia | 8.1 |

| United States | 7.1 |

| France | 6.4 |

| Jersey | 5 |

| Switzerland | 4.8 |

| Finland | 3.7 |

| Taiwan | 3.5 |

| China | 3.1 |

| Other/Cash | 4.7 |

Benefits of Investing in ACDC ETF

Embarking on an investment journey with the ACDC ETF offers several benefits, many of which are indicative of the industries it invests in’s revolutionary ability. The following are some solid arguments for why investors are drawn to ACDC:

- Forward-Thinking Investment: At its core, ACDC is an innovation hub, concentrating on sectors that are defining our present and our future. Investing in ACDC is a good strategy to keep up with the sustainability and technology developments that will likely fuel economic growth over the next many decades.

- Possibility of Robust Returns: ACDC is well-positioned to profit from the spike in demand for greener and more effective energy solutions because it concentrates on the electric car, battery, and renewable energy sectors. This posture offers a substantial potential for growth-oriented profits and is in line with global environmental aspirations.

- Ethical Investment Option: ACDC appeals to many people on a deeper, values-driven level who are committed to environmental sustainability, even beyond the prospect of financial reward. Investors in ACDC help create a healthy planet by funding businesses essential to the shift to a more sustainable global economy.

Risks and Considerations

While the ACDC ETF offers enticing prospects, investors must navigate with a clear understanding of the potential risks and considerations:

- Market Volatility: Although full of potential, the industries supporting ACDC are by nature unstable and susceptible to several variables, such as modifications in technology, changes in laws, and developments in the world economy.

- Emerging Technology Risks: Investing in industries driven by innovation and new technologies carries the risk of obsolescence. Rapid advancements could render current technologies outdated, impacting companies within ACDC’s portfolio.

- Sector-Specific Challenges: Despite their growth, the renewable energy and electric vehicle (EV) markets face some difficulties, such as supply chain disruptions, geopolitical tensions, and competition.

Like any investment, investing in the ACDC ETF necessitates a balanced strategy considering both the inherent dangers and the fund’s potential prospects. Investors can successfully navigate the complex and intriguing landscape that ACDC represents if they have a long-term outlook and a plan that considers both the possibility of growth and the realities of market dynamics.

Investing in the ACDC ETF provides a clear route for individuals who want to capitalise on the expansion of renewable energy and electric car markets. Here’s how to do this procedure easily.

How to Buy ACDC ASX Shares

- Select a Brokerage Platform: The first step in your journey is to select a brokerage that provides access to the ASX. Many platforms provide online and mobile access, making managing your investments on the go easy.

- Set Up and Fund Your Account: After selecting a broker, you must create an account and add the money you want to invest. As this process can differ slightly throughout platforms, adhere to the broker’s instructions.

- Research and Decide: Before acquiring shares of ACDC, invest some time in learning about the ETF’s past performance, present market position, and projected future growth. Making investing decisions that align with your financial objectives and risk tolerance requires an educated approach.

- Place Your Order: With your account set up and your research in hand, You can order through your brokerage platform, specifying the number of shares you wish to purchase and your preferred price point.

- Monitor Your Investment: After buying shares of ACDC, it’s important to monitor your investment. In order to make informed decisions about your ACDC holdings in the future, monitor market trends, company news, and performance metrics.

Platforms and Strategies

Choosing the right investment platform and strategy significantly affects your investment journey. Consider these factors when making your choice:

- Ease of Use: Choose a platform with a robust customer care system and an intuitive user interface.

- Fees and Commissions: Be aware of any fees or commissions charged by the platform, as these can affect your investment returns.

- Investment Strategy: Whether you prefer a long-term hold, frequent trading, or dollar-cost averaging, ensure your platform supports your investment style.

- Diversification: While ACDC offers a unique opportunity to invest in the future of energy and transportation, remember the importance of diversification. Consider how ACDC fits within your broader portfolio to mitigate risk and achieve a balanced investment approach.

Future Outlook for ACDC ETF

The ACDC ETF is positioned at the forefront of significant global transitions. The push for cleaner energy solutions and the electrification of transportation are trends with robust momentum underpinned by innovation and policy support. As these sectors evolve, ACDC offers investors a vehicle to gain exposure to their growth while contributing to a sustainable future.

- The increasing adoption of EVs, driven by advancements in battery technology and supportive government policies, bodes well for ACDC’s focus sectors.

- The global emphasis on reducing carbon emissions and transitioning to renewable energy sources further enhances the appeal of ACDC’s investment strategy.

- Technological innovations and cost reductions in battery and renewable energy technologies are expected to continue, potentially boosting the sectors ACDC invests in and, by extension, the ETF itself.

Investing in ACDC, therefore, represents more than a financial decision; it’s a forward-looking choice that aligns with the trajectory of global energy and transportation trends. For those willing to navigate the inherent risks and volatility of these dynamic sectors, ACDC offers a conduit to participate in the growth of technologies shaping a sustainable future.

Hence, investing in ACDC is a proactive move that fits with the direction of global energy and transport trends rather than just being a financial decision. ACDC provides a pathway to engage in the development of technologies that are reshaping a sustainable future for individuals prepared to manage the inherent risks and volatility of these rapidly evolving industries.

FAQs about the ACDC ETF

1. What is the ACDC ETF, and what does it invest in?

The ACDC ETF is an investment fund traded on the Australian Securities Exchange (ASX) specialising in electric vehicle (EV) and battery technology sectors. It pools resources into companies leading the charge in these areas, aiming to capitalise on the global shift towards renewable energy and sustainable transportation solutions.

2. How has the ACDC ASX share price performed historically?

The ACDC ASX share price has historically experienced fluctuations reflective of the inherent volatility in the renewable energy and EV markets. Despite this, its trajectory has generally pointed upwards, mirroring the increasing adoption of sustainable technologies worldwide. Investors should note that past performance is not always indicative of future results.

3. What are the benefits and risks of investing in ACDC ETF?

Benefits include potential robust returns driven by the growth of the EV and renewable energy sectors, diversification within these burgeoning industries, and alignment with sustainability and ESG principles. Risks involve market volatility, sector-specific challenges, and the emerging nature of the technologies within ACDC’s investment focus, which may impact short-term performance.

4. How can I buy ACDC shares on the ASX?

Investors can buy ACDC shares through any brokerage platform that provides access to the ASX. The process involves setting up a brokerage account, funding it, researching ACDC’s current position and market outlook, and placing an order for shares according to your investment strategy.

5. What makes ACDC ETF unique compared to other ETFs?

ACDC’s uniqueness lies in its focused investment strategy on the EV and battery technology sectors. This specialised approach offers investors a direct avenue to participate in the growth of these critical and fast-evolving industries, distinguished from broader market ETFs or those targeting different sectors.

6. How does ACDC ETF fit into a sustainable investment strategy?

ACDC ETF fits seamlessly into a sustainable investment strategy by focusing on sectors pivotal to transitioning towards a cleaner, more sustainable future. Its emphasis on renewable energy and electric transportation aligns with investors’ goals of contributing positively to environmental sustainability while pursuing financial returns.

Conclusion

Our journey through the ACDC ETF review illuminates a path where innovation meets investment, offering a unique opportunity to be part of the electrifying shift towards sustainability and technological advancement. ACDC stands as a testament to the potential of focused investment in sectors that are shaping the future of energy and transportation and are also critical to the global sustainability agenda.

As we’ve shown, purchasing ACDC appeals to investors who want to make a positive environmental impact and capitalise on the expanding EV and battery technology businesses. Though they should be aware of the dangers and volatility associated with these industries, astute investors can see in ACDC a means of participating in and profiting from the revolutionary developments shaping our day.

Table of References

| Website | Description |

| Australian Securities Exchange (ASX) | Official site for the Australian stock market. Provides detailed information on listed companies, including GOLD ETFs. |

| https://www.globalxetfs.com.au/ | |

| The Perth Mint | One of the largest and most respected mints in the world, it provides information on gold investment products, including ETFs backed by physical gold. |

| Morningstar Australia | A leading provider of independent investment research, offering analysis and ratings on ETFs, including GOLD ETFs. |

| ETF Securities Australia | It specializes in ETF and ETP solutions, offering various investment products, including those focused on gold. |

Explore other ETF options in our Shares & ETFs section. Find a wide range of ETFs to suit your investment preferences and goals. You can also check our property investment articles for more opportunities.

Important Disclaimer: Not a Licensed Financial Advisor

The information and insights provided in this document are intended solely for educational and informational purposes. It’s imperative to understand that I am not a licensed financial advisor, tax expert, or investment strategist. The contents herein are crafted to offer a general overview and should not be construed as personalized financial advice.

Before making any financial decisions or embarking on investment ventures, it’s crucial to consult with a professional financial advisor or a certified tax consultant who is well-equipped to understand your unique financial landscape. Engaging with a licensed professional ensures that the advice you receive is tailored to your specific financial goals, risk tolerance, and tax obligations, adhering to the compliance and guidelines established by regulatory authorities, including the Australian Taxation Office (ATO) and other relevant bodies.

Financial markets are complex and dynamic and involve various degrees of risk. Therefore, thorough due diligence and professional guidance are essential to navigate these waters effectively. This content does not represent the opinions or endorsements of any financial institutions or regulatory agencies. Remember, the responsibility for financial decisions lies with the individual, and seeking qualified advice is the best step towards informed decision-making and achieving financial objectives.

1 thought on “Is ACDC ETF the Future of Investing? Our Latest Review!”