The Vanguard Australian Shares High Yield VHY ETF is an exchange-traded fund (ETF) that aims to provide investors with a steady stream of income by tracking the performance of the FTSE Australia High Dividend Yield Index. Launched in May 2011, VHY has become a popular choice for income-seeking investors looking to capitalize on the dividend-paying potential of the Australian equity market. This review delves into VHY’s performance, strategy, holdings, and more to provide investors with a thorough understanding of what this ETF can offer.

How Does VHY Work?

VHY is designed to invest in a portfolio of Australian companies that are expected to pay higher-than-average dividends relative to their peers. Unlike many other high-yield ETFs that rely solely on historical dividend data, VHY uses forward-looking broker estimates to identify and rank the highest-yielding securities. This approach allows the fund to capture companies that are forecast to pay attractive dividends, regardless of their past dividend history.

The FTSE Australia High Dividend Yield Index, which VHY tracks, selects the highest-yielding Australian stocks until it reaches approximately 50% of the market capitalization of the broader Australian equity universe. To ensure diversification, the index imposes sector and individual stock caps, limiting exposure to any single industry at 40% and any individual security at 10%.

One notable feature of VHY is that it excludes Australian Real Estate Investment Trusts (A-REITs) from its portfolio, as the fund aims to provide exposure to high-yielding non-REIT companies.

Performance and Holdings

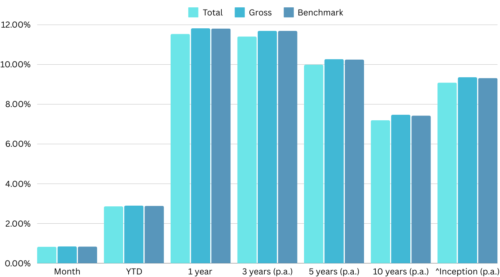

Since its inception, VHY has delivered impressive returns, outperforming its benchmark index and the broader Australian equity market. As of February 29, 2024, the ETF has returned 9.36% per annum since its launch, compared to 9.32% for its benchmark and 9.16% for the S&P/ASX 300 Index.

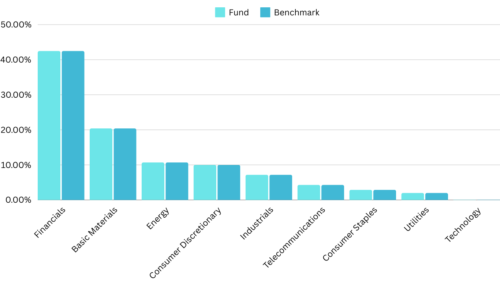

VHY’s top holdings as of February 2024 include Commonwealth Bank of Australia, BHP Group Ltd., National Australia Bank Ltd., Wesfarmers Ltd., and Westpac Banking Corp. The fund’s portfolio comprises 72 holdings, with a heavy allocation to the financials (42.4%), materials (20.4%), and energy (10.7%) sectors.

Top 5 Holdings

| Holding name | Percentage of net assets |

|---|---|

| Commonwealth Bank of Australia | 9.65% |

| BHP Group Ltd. | 8.73% |

| National Australia Bank Ltd. | 7.75% |

| Wesfarmers Ltd. | 7.33% |

| Westpac Banking Corp. | 6.71% |

Sector Allocation

Total Returns

Dividends and Franking Credits

VHY’s strategic selection of holdings has delivered consistent performance over the years. As of the end of February 2024, the ETF showcased a commendable track record, with a 1-year return of 11.82%, and even more impressively, a return of 9.36% per annum since inception. Such figures illustrate VHY’s capability to provide investors with substantial income through dividends alongside the potential for capital growth.

One of the key advantages of investing in VHY is its ability to generate a steady stream of income through dividend distributions. The ETF pays quarterly distributions, with the option for investors to reinvest their dividends or receive cash payments.

Additionally, VHY offers investors access to franking credits, which can provide further tax benefits for Australian investors. The fund’s franking level, which indicates the amount of imputation tax credits attributed to the net tax paid by the fund, has historically been high, ranging from 89.8% to 98.39% over the past five years.

Fees and Liquidity

With a management fee of 0.25% per annum, VHY is a cost-effective way to gain exposure to high-yielding Australian equities. The ETF’s tight bid-ask spreads and high liquidity, facilitated by its large fund size of over $5 billion, also make it an attractive option for investors seeking efficient trading and accurate pricing.

Pros and Cons

Pros:

- Exposure to high-yielding Australian stocks

- Forward-looking dividend estimation methodology

- Diversification across sectors and stocks

- Access to franking credits

- Low management fees

- High liquidity and tight spreads

Cons:

- Concentration risk in financials and materials sectors

- The exclusion of A-REITs may limit the potential upside.

- Dividend yields can fluctuate, impacting the income stream

Risks and Considerations

While VHY offers numerous benefits, investors must also be aware of potential risks. The ETF’s focus on high-dividend-yielding companies means it may be more exposed to sector-specific downturns, particularly in financials and materials, sectors that can be sensitive to economic cycles. Moreover, high-yield stocks may underperform during bull markets when investors prioritize growth over income.

Conclusion

In summary, the Vanguard Australian Shares High Yield ETF (VHY) is a well-diversified and cost-effective investment option for investors seeking regular income distributions and the potential for capital appreciation from the Australian equity market. With its unique dividend-focused methodology, exposure to franking credits, and Vanguard’s proven investment expertise, VHY presents an attractive opportunity for income-oriented investors to enhance their portfolio’s yield.

What is the investment objective of VHY ETF?

VHY aims to track the performance of the FTSE Australia High Dividend Yield Index, which comprises Australian companies with higher forecast dividends relative to their peers.

How does VHY ETF select its holdings?

VHY uses forward-looking broker estimates to rank Australian stocks from highest to lowest yield. It selects the highest-yielding securities until it reaches approximately 50% of the market capitalization of the Australian equity universe.

Does VHY ETF include A-REITs?

No, Australian Real Estate Investment Trusts (A-REITs) are excluded from the VHY portfolio.

How often are VHY ETF dividends paid, and can they be reinvested?

VHY pays quarterly distributions, and investors have the option to reinvest their dividends back into the ETF or receive cash payments.

Does VHY ETF provide access to franking credits?

Yes, VHY offers investors exposure to franking credits, which can provide tax benefits for Australian investors.

What is the management fee for VHY ETF?

The management fee for VHY is 0.25% per annum.

How liquid is the VHY ETF?

VHY is highly liquid, with a large fund size of over $5 billion and tight bid-ask spreads, facilitating efficient trading and accurate pricing.

What are the risks associated with investing in VHY ETF?

Some risks include concentration risk in sectors like financials and materials, fluctuations in dividend yields affecting income stream, and the exclusion of A-REITs potentially limiting upside potential.

How has VHY ETF performed compared to its benchmark and the broader Australian equity market?

Since its inception, VHY has outperformed its benchmark index (FTSE Australia High Dividend Yield Index) and the S&P/ASX 300 Index.

Explore other ETF options in our Shares & ETFs section. Find a wide range of ETFs to suit your investment preferences and goals. You can also check our property investment articles for more opportunities.

References

| Website Name | Description | URL |

|---|---|---|

| Australian Securities Exchange (ASX) | Official site for Australian stock market news, including details on ETFs like VHY. | asx.com.au |

| Vanguard Australia | The issuer of VHY ETF, providing detailed fund information, performance, and insights. | vanguard.com.au |

| Morningstar Australia | Offers investment research and analysis, including ratings and reviews on various ETFs. | morningstar.com.au |

| Financial Review | A leading source for financial and investment news in Australia, including ETF analysis. | afr.com |

| InvestSMART | Provides investment advice, tools, and services, including ETF comparisons and analyses. | investsmart.com.au |

Share Your Thoughts and Experiences

Share your thoughts, questions, and insights in the comments below.

We’d also love to hear your feedback on this article. Did you find it informative and engaging? Are there any additional topics or aspects of the ETF you’d like us to cover? Your input helps us create even better content for the Aussie investing community.

Remember, investing involves risks, and it’s crucial to conduct your own research and seek professional advice before making any investment decisions. The ETF may or may not be the right fit for your specific circumstances, but we hope this review has provided you with a comprehensive understanding of this popular Australian ETF.

Happy investing, and stay tuned for more insightful content from our team!

Important Disclaimer: Not a Licensed Financial Advisor

The information and insights provided in this document are intended solely for educational and informational purposes. It’s imperative to understand that I am not a licensed financial advisor, tax expert, or investment strategist. The contents herein are crafted to offer a general overview and should not be construed as personalized financial advice.

Before making any financial decisions or embarking on investment ventures, it’s crucial to consult with a professional financial advisor or a certified tax consultant who is well-equipped to understand your unique financial landscape. Engaging with a licensed professional ensures that the advice you receive is tailored to your specific financial goals, risk tolerance, and tax obligations, adhering to the compliance and guidelines established by regulatory authorities, including the Australian Taxation Office (ATO) and other relevant bodies.

Financial markets are complex and dynamic and involve various degrees of risk. Therefore, thorough due diligence and professional guidance are essential to navigate these waters effectively. This content does not represent the opinions or endorsements of any financial institutions or regulatory agencies. Remember, the responsibility for financial decisions lies with the individual, and seeking qualified advice is the best step towards informed decision-making and achieving financial objectives.

1 thought on “The VHY ETF Review Reveals How to Supercharge Your Income!”