With the recent news about Australia’s revised Stage 3 tax cuts, it is important to understand how these changes could affect your finances. This article aims to simplify the complexities of the tax changes and present them to you in an easy-to-understand manner. By reading this article, you will clearly understand how these changes could impact your future tax liabilities.

Background on Australia’s Tax System

Australia’s tax system is progressive, which means the more you earn, the higher the rate of tax you pay. Tax brackets determine the portion of your income that will be taxed at a particular rate. Recently, these brackets have been under the spotlight as the government aims to provide relief in challenging economic times.

What are the Stage 3 Tax Cuts?

Introduced by the previous government, the original Stage 3 tax cuts were set to simplify the tax system, reducing the number of brackets and lowering rates for certain income ranges. The highest income earners were to benefit significantly, sparking debate about the fairness of this distribution.

Stage 3 Tax Cut Calculator

Australia Tax Calculator for 2024-25

The Revised Stage 3 Tax Cuts

In a bid to support those feeling the pinch, the new tax plan has been reshaped. These adjustments ensure a more equitable approach, allowing more Australians to keep a larger portion of their earnings.

Below are ATO tax rates in 2024

| Tax Rate | Income Range |

|---|---|

| 0% | Up to $18,200 |

| 16% | $18,201 – $45,000 |

| 30% | $45,001 – $135,000 |

| 37% | $135,001 – $190,000 |

| 45% | Over $190,000 |

Implications for Different Income Groups

The average tax rate for earners between $45,000 and $135,000 has decreased from 32.5% to 30%. Previously slated for a sizeable cut, high-income earners have seen less reduction, aligning tax relief with current economic realities.

Inclusion of the Medicare Levy

The Medicare levy, traditionally 2% of your taxable income, remains an integral part of the system. This levy supports the public health system and is scaled according to income, ensuring it contributes to the broader social good.

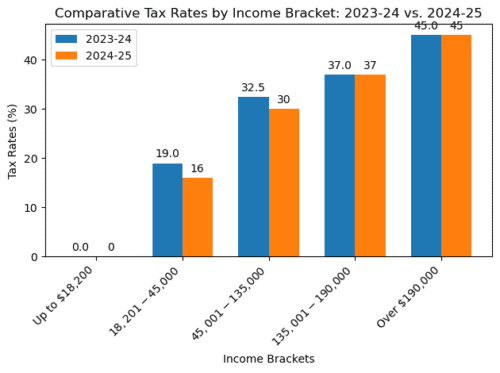

Visualizing the Impact of Stage 3 Tax Cuts on Different Income Brackets

How the New Tax Legislation Affects You

The upcoming Stage 3 tax cuts represent a significant shift in Australia’s tax landscape, particularly for the middle-class. Set to take effect in July 2024, these changes aim to alleviate the tax burden across various income levels, fostering greater economic equity and stimulating growth. To help you visualize what these tax cuts mean for different income brackets, we’ve created comparative bar graphs that illustrate the adjustments in tax rates from the financial year 2023-24 to 2024-25.

Figure 1: This bar graph compares the tax rates for different income brackets between the years 2023-24 and 2024-25. As shown, significant reductions in tax rates are evident for middle-income brackets, which are aimed at reducing overall tax liability and increasing disposable income.

In the graph, each pair of bars represents a specific income bracket, showcasing both the current and future tax rates. For instance, taxpayers earning between $45,001 and $135,000 will see their tax rate decrease from 32.5% to 30%. This change not only simplifies the tax system but also ensures that hard-working Australians keep more of what they earn.

Understanding these changes is crucial for planning your financial future. Whether you are budgeting for next year’s expenses or planning long-term investments, knowing how your tax obligations will shift can help you make more informed decisions. For those looking to maximize their savings under the new tax regime, considering additional investment opportunities or adjusting your tax withholding could be beneficial strategies.

Understanding the Impact of Stage 3 Tax Cuts: Real-Life Scenarios

To better understand how the upcoming Stage 3 tax cuts will affect individuals at different income levels, let’s explore two hypothetical scenarios. These examples use the actual tax brackets for the financial years 2023-24 and 2024-25, demonstrating the potential tax savings.

Scenario 1: Emily, a Graphic Designer Earning $75,000 Annually

Tax Liability Before Stage 3 Tax Cuts (2023-24):

- Income: $75,000

- Calculation:

- $0 for income up to $18,200

- 19% on income from $18,201 to $45,000 = $(45,000 – 18,200) * 19% = $5,092

- 32.5% on income from $45,001 to $75,000 = $(75,000 – 45,000) * 32.5% = $9,750

- Total Tax Liability: $5,092 + $9,750 = $14,842

Tax Liability After Stage 3 Tax Cuts (2024-25):

- Income: $75,000

- Calculation:

- $0 for income up to $18,200

- 16% on income from $18,201 to $45,000 = $(45,000 – 18,200) * 16% = $4,288

- 30% on income from $45,001 to $75,000 = $(75,000 – 45,000) * 30% = $9,000

- Total Tax Liability: $4,288 + $9,000 = $13,288

Savings:

- Emily will save $1,554 annually due to the Stage 3 tax cuts.

Scenario 2: David, an IT Manager Earning $180,000 Annually

Tax Liability Before Stage 3 Tax Cuts (2023-24):

- Income: $180,000

- Calculation:

- $0 for income up to $18,200

- 19% on income from $18,201 to $45,000 = $(45,000 – 18,200) * 19% = $5,092

- 32.5% on income from $45,001 to $120,000 = $(120,000 – 45,000) * 32.5% = $24,375

- 37% on income from $120,001 to $180,000 = $(180,000 – 120,000) * 37% = $22,200

- Total Tax Liability: $5,092 + $24,375 + $22,200 = $51,667

Tax Liability After Stage 3 Tax Cuts (2024-25):

- Income: $180,000

- Calculation:

- $0 for income up to $18,200

- 16% on income from $18,201 to $45,000 = $(45,000 – 18,200) * 16% = $4,288

- 30% on income from $45,001 to $135,000 = $(135,000 – 45,000) * 30% = $27,000

- 37% on income from $135,001 to $180,000 = $(180,000 – 135,000) * 37% = $16,650

- Total Tax Liability: $4,288 + $27,000 + $16,650 = $47,938

Savings:

- David will save $3,729 annually due to the Stage 3 tax cuts.

Conclusion

The revised Stage 3 tax cuts are more than just numbers on a page—they represent a significant shift in policy to support Australians through tax relief. By staying informed and proactive, you can make the most of these changes. For more information, visit ATO’s website.

What are the tax cuts for July 2024?

The tax cuts set for July 2024 aim to simplify the tax structure and provide relief by adjusting rates and brackets. The notable changes include reducing the tax rate for incomes between $45,001 and $135,000 to 30% and adjusting the threshold for the 37% rate to start from $135,001 up to $190,000.

How much tax will I pay in 2024

Your tax in 2024 will depend on your income bracket. For example, if your annual income is $75,000, your tax, before any deductions or offsets including the Medicare levy, would be calculated based on the cumulative tax rate for each income segment up to your total income.

What are the current tax brackets in Australia?

0% on income up to $18,200

16% for income between $18,201 – $45,000

30% for income between $45,001 – $135,000

37% for income between $135,001 – $190,000

45% for income over $190,000

How will Stage 3 tax cuts affect me?

The Stage 3 tax cuts could lower the tax you pay if your income is within certain ranges. They are designed to reduce bracket creep and leave more money in taxpayers’ pockets.

What are the revised stage 3 tax cuts?

The revised Stage 3 tax cuts, effective from July 2024, feature adjustments to tax rates and brackets to provide significant relief, especially to middle-income earners. Key changes include lowering the tax rate for incomes between $45,001 and $135,000 to 30% and adjusting the upper thresholds to alleviate bracket creep.

How much will I save with the Stage 3 tax cuts?

Savings will vary by income bracket. Use tools like the “stage 3 tax cuts calculator” to estimate your potential savings based on the new tax brackets and rates.

What are the tax changes effective 1 July 2024?

Effective 1 July 2024, the tax changes include revised tax brackets to lower tax rates for several income levels, aiming to boost disposable income and economic activity.

What is the low-income tax offset for 2024?

The low-income tax offset (LITO) for 2024 is set to increase, allowing lower-income earners to potentially receive greater tax relief, thereby reducing their overall tax payable.

How much tax will I get back if I earn $60,000?

If you earn $60,000, your tax, including the low-income tax offset and not accounting for any other deductions or credits, can be estimated using the “stage 3 tax cuts calculator 2024”. The exact amount will depend on your personal circumstances and any additional deductions you may claim.

What will ATO tax rates be in 2024?

In 2024, ATO tax rates will reflect the newly adjusted tax brackets from the Stage 3 tax cuts, which aim to reduce tax rates across various income brackets, particularly benefiting middle-income earners.

How do high-income earners reduce taxes in Australia?

High-income earners can reduce their tax liabilities through various legal strategies such as salary sacrificing, investing in tax-effective investment vehicles, maximizing deductible expenses, and making charitable donations.

What happens if I don’t claim the tax-free threshold?

If you do not claim the tax-free threshold, more tax will be withheld from your pay throughout the year, potentially leading to a larger refund when you file your tax return, assuming no other tax liabilities.

What is the tax-free threshold in Australia?

The tax-free threshold in Australia is $18,200, which means you do not pay tax on your income up to this amount each financial year. This applies to most taxpayers.

Expand Your Financial Knowledge: Visit our Personal Finance section for essential tips, delve into Property Investing for the latest market insights, or explore our comprehensive Resources for educational articles and tools. If you’re interested in the stock market, our Shares & ETFs section offers a range of options to suit your investment goals. Dive into these areas to enhance your financial understanding and decision-making.

Disclaimers

Estimation Only, Not a Prediction: Please be aware that the tax calculations provided in this article are estimations only and not predictions. They are based on the inputs you provide and standard calculation methods intended for educational and illustrative purposes. The actual tax amounts you may be required to pay could be higher or lower. These calculations cannot account for unpredictable factors that may affect individual tax situations, such as changes in law or personal circumstances.

Exclusion of Additional Taxes and Charges: This tool does not consider other taxes, levies (such as the Medicare levy when not specified), or any potential deductions or offsets that might apply when filing your taxes. These factors can significantly affect the actual tax amount.

Not a Substitute for Professional Advice: The information provided here should not be used as the sole basis for making financial decisions. It does not account for all aspects of your financial situation and does not provide personalized advice. Before making any significant decisions related to your taxes, consider consulting with a licensed tax professional or financial adviser who can provide tailored advice based on your individual circumstances.

Use at Your Own Risk: By using the information in this article, you acknowledge that the calculations are estimates only and that your actual tax obligations may vary. Any reliance you place on such information is strictly at your own risk.

Not a Licensed Financial Advisor

The information and insights provided in this document are intended solely for educational and informational purposes. It’s imperative to understand that I am not a licensed financial advisor, tax expert, or investment strategist. The contents herein are crafted to offer a general overview and should not be construed as personalized financial advice.

Affiliate Disclosure: Some of the links on this blog may be affiliate links. This means if you click on the link and purchase a product or service, I may receive a commission at no additional cost to you. I only recommend products or services that I believe in, and that may be helpful to my readers.

Before making any financial decisions or embarking on investment ventures, it’s crucial to consult with a professional financial advisor or a certified tax consultant who is well-equipped to understand your unique financial landscape. Engaging with a licensed professional ensures that the advice you receive is tailored to your specific financial goals, risk tolerance, and tax obligations, adhering to the compliance and guidelines established by regulatory authorities, including the Australian Taxation Office (ATO) and other relevant bodies.

Financial markets are complex and dynamic and involve various degrees of risk. Therefore, thorough due diligence and professional guidance are essential to navigate these waters effectively. This content does not represent the opinions or endorsements of any financial institutions or regulatory agencies. Remember, the responsibility for financial decisions lies with the individual, and seeking qualified advice is the best step towards informed decision-making and achieving financial objectives.