Exchange-traded funds (ETFs) are popular among investors for their simplicity and efficiency. They offer a way to invest in a wide array of assets through a single transaction. Today, we’ll delve into two notable ETFs in the Australian market: Vanguard’s Diversified High Growth Index ETF (VDHG) and BetaShares’ Diversified All Growth ETF (DHHF). This comparison of VDHG vs DHHF will guide novice investors through the nuances of each, helping you decide which might suit your investment strategy better.

Overview of Each ETF

Vanguard Diversified High Growth Index ETF (VDHG)

VDHG is designed for investors looking for high growth by investing in a diversified portfolio that includes Australian and international equities, bonds, and real estate. Here are the essentials:

- Investment Strategy: Predominantly growth-focused, targeting a 90% allocation to growth assets.

- Geographic Exposure: Broad, including significant investments in both Australian and global markets.

- Performance: Strong historical performance with a focus on long-term capital growth.

BetaShares Diversified All Growth ETF (DHHF)

DHHF aims to provide low-cost exposure to a diversified portfolio entirely focused on growth assets. Key details include:

- Investment Strategy: 100% allocation to equities, targeting both Australian and international markets.

- Geographic Exposure: Extensive, with a heavy emphasis on US equities.

- Performance: Competitive returns, particularly appealing for those with a long-term investment horizon.

Investment Strategies and Asset Allocation

Investment Approach

Both VDHG and DHHF utilize a passive investment strategy, but their asset allocations differ significantly. VDHG includes a mix of growth and income assets, whereas DHHF is fully invested in growth assets. This fundamental difference impacts potential returns and the risk profile of each ETF.

Growth vs. Income Assets

The allocation of growth versus income assets is crucial in determining the potential volatility and returns of an investment:

| ETF Name | Growth Assets | Income Assets |

|---|---|---|

| VDHG | 90% | 10% |

| DHHF | 100% | 0% |

Detailed Comparison of Holdings and Asset Classes

Understanding the specific holdings and asset classes of each ETF is crucial for investors who want to know exactly what they are investing in. This detailed comparison will help highlight the diversification and specific market focuses of VDHG and DHHF.

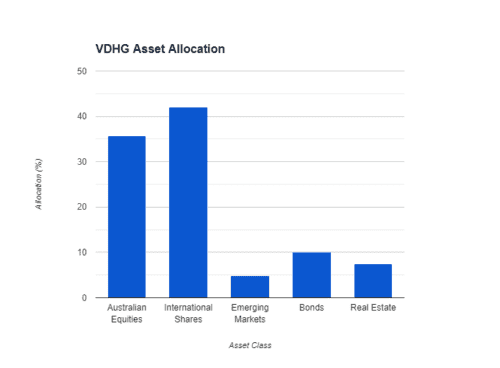

VDHG Holdings and Asset Classes

VDHG provides a diversified approach by combining different asset classes, which include:

- Australian Equities: Represents a significant portion of the portfolio with investments in top Australian companies.

- International Equities: Includes investments in major global markets such as the USA, Europe, and Asia.

- Bonds: A smaller but important component, providing income and reducing overall portfolio volatility.

- Real Estate: Included via real estate investment trusts (REITs), contributing to both growth and income.

Asset Allocation Overview:

| VDHG Asset Class | Allocation |

|---|---|

| Australian Equities | 35.7% |

| International Shares | 42.1% |

| Emerging Markets | 4.81% |

| Bonds | 10% |

| Real Estate | 7.39% |

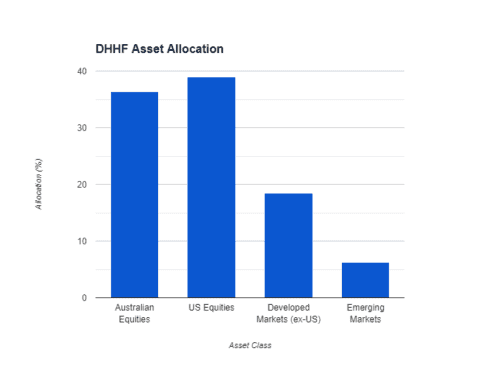

DHHF Holdings and Asset Classes

DHHF is fully invested in equities, targeting high growth through:

- Australian Equities: Strong focus on the Australian market, including large, mid, and small-cap companies.

- US Equities: The largest geographic exposure, investing in a broad range of American companies.

- Developed Markets – ex-US: Investments in developed countries outside of the US, like the UK, Japan, and Canada.

- Emerging Markets: Exposure to high-growth potential markets, including China, India, and Brazil.

Asset Allocation Overview:

| DHHF Asset Class | Allocation |

|---|---|

| Australian Equities | 36.4% |

| US Equities | 39.0% |

| Developed Markets (ex-US) | 18.4% |

| Emerging Markets | 6.2% |

Comparative Analysis of Holdings

When comparing VDHG and DHHF, it’s evident that both ETFs provide significant exposure to equities, but there are key differences:

- VDHG offers a blend of growth and income assets, with a notable portion allocated to bonds and real estate, making it potentially more stable during market fluctuations.

- DHHF is more aggressive, with a 100% allocation to equities, which may offer higher growth potential but with increased volatility.

Top Holdings Comparison between VDHG and DHHF ETFs

| VDHG Holdings | Percentage of VDHG | DHHF Holdings | Percentage of DHHF |

|---|---|---|---|

| Vanguard Australian Shares Index Fund | 35.93% | Vanguard Total Stock Market ETF (VTI) | 40.57% |

| Vanguard International Shares Index Fund | 26.49% | BetaShares Australia 200 ETF (A200) | 33.70% |

| Vanguard International Shares Index Fund Hedged | 16.19% | SPDR® Portfolio Developed Wld ex-US ETF (SPDW) | 19.23% |

| Vanguard Global Aggregate Bond Index Fund Hedged | 7.00% | SPDR® Portfolio Emerging Markets ETF (SPEM) | 6.50% |

| Vanguard International Small Companies Index Fund | 6.54% | – | – |

| Vanguard Emerging Markets Shares Index Fund | 4.86% | – | – |

| Vanguard Australian Fixed Interest Index Fund | 2.98% | – | – |

The choice between VDHG and DHHF should consider an investor’s risk tolerance, investment goals, and the desired balance between stability and high growth potential. This section provides a clear view of where each ETF focuses its investments, helping you make a more informed decision based on what best fits your financial landscape.

Performance and Costs (VDHG VS DHHF)

Performance Comparison

To give you a clearer picture, let’s look at the performance over the past years:

Trailing Returns and Benchmarks

| Time Frame | VDHG YTD Return | DHHF YTD Return |

|---|---|---|

| YTD | 6.19% | 7.97% |

| 1-Month | 8.10% | 9.90% |

| 3-Month | 2.92% | 3.09% |

| 1-Year | 15.18% | 17.67% |

| 3-Year | 6.96% | 9.15% |

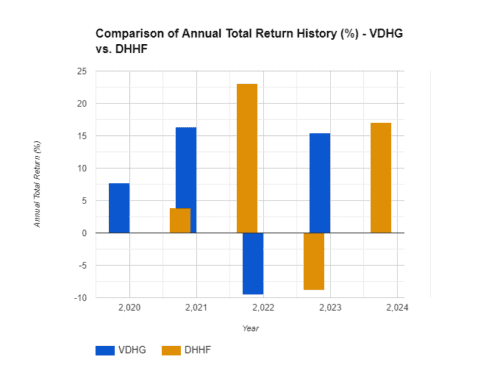

Annual Total Return History (%)

| Year | VDHG Return | DHHF Return |

|---|---|---|

| 2023 | 15.48% | 16.99% |

| 2022 | -9.54% | -8.92% |

| 2021 | 16.40% | 23.07% |

| 2020 | 7.70% | 3.81% |

| 2019 | 23.63% | N/A |

| 2018 | -2.21% | N/A |

In the year-to-date (YTD) returns, DHHF leads slightly with 7.97% compared to VDHG’s 6.19%. The 1-month and 3-month returns also favor DHHF over VDHG.

For the 1-year trailing return, DHHF again shows a higher return at 17.67%, compared to VDHG’s 15.18%. When extending to a 3-year period, DHHF continues to maintain higher returns at 9.15%, whereas VDHG shows returns of 6.96%.

Looking at the annual total return history, we see some variance between the two ETFs year over year. VDHG had a notable dip in 2022 and 2018, while DHHF also saw a dip in 2022, but less historical data is available for comparison. VDHG had a strong recovery in 2021, just slightly below DHHF’s impressive 23.07%.

It’s important for investors to consider that past performance is not indicative of future results. DHHF’s higher returns may be associated with higher risk due to its 100% allocation to equities, as opposed to VDHG’s diversified approach, which includes bonds. As such, DHHF might be suitable for investors with a higher risk tolerance seeking long-term growth, while VDHG may appeal to those looking for a mix of growth and income with a more conservative risk profile.

Fees, Expenses, and Costs

Understanding the impact of fees on your investment is crucial:

| ETF Name | Management Fee |

|---|---|

| VDHG | 0.27% p.a. |

| DHHF | 0.19% p.a. |

Lower fees typically mean more of your investment returns are yours to keep.

Risk and Return Analysis

Risk Assessment

Investing in ETFs comes with inherent risks, but diversification can mitigate some of these:

| ETF Name | Risk Level |

|---|---|

| VDHG | High |

| DHHF | High |

Both ETFs are suitable for investors with a high tolerance for risk, given their focus on growth assets.

Return Analysis

While both ETFs aim for high returns, their different asset allocations might sway your decision depending on your comfort with risk and your investment timeframe.

Dividends and Distributions

Neither ETF primarily targets income through dividends, but both distribute income from their holdings, typically on a quarterly basis. This can be reinvested to compound growth.

Investor Suitability and Advice

Ideal Investor Profile

- VDHG: Suitable for those who prefer a mix of growth and income, willing to accept moderate to high risk.

- DHHF: Best for investors seeking aggressive growth from their investments, comfortable with higher risks.

Strategic Portfolio Inclusion

Incorporating these ETFs into your portfolio should be aligned with your overall investment strategy and risk tolerance. They can serve as a significant component of your portfolio aimed at long-term growth.

Conclusion

VDHG and DHHF both offer unique opportunities for investors. Your choice between them should depend on your risk tolerance, investment goals, and how actively you wish to manage your portfolio. By comparing VDHG and DHHF, this blog post aims to equip you with the knowledge to choose the ETF that best fits your investment strategy. As with any investment, it’s advisable to consult with a financial advisor to tailor your investments to your personal financial situation. Happy investing!

FAQs

Why consider VDHG or DHHF?

They offer diversified exposure with a single transaction, which is suitable for long-term growth.

What is the main difference between VDHG and DHHF ETFs?

VDHG aims for high growth with a diversified approach, including bonds and real estate, to mitigate risk. DHHF is an all-equity ETF targeting growth assets, reflecting a higher risk and growth potential strategy.

Are VDHG and DHHF suitable for retirement savings?

Both ETFs could be suitable for retirement savings, depending on your investment horizon and risk tolerance. VDHG’s diversified portfolio might appeal to those seeking stability along with growth, while DHHF might suit those with a longer timeframe and a preference for higher growth potential.

How often do VDHG and DHHF pay dividends?

Both VDHG and DHHF typically distribute dividends quarterly. These can provide a regular income stream, which investors may choose to reinvest.

Can I invest in VDHG or DHHF if I’m not based in Australia?

Yes, non-Australian residents can invest in these ETFs, but they should consult with a financial advisor to understand the tax implications and comply with investment regulations in their home country.

How do VDHG and DHHF fit into a balanced investment portfolio?

VDHG can serve as a core growth component due to its diversified nature. DHHF, with its 100% equity focus, may be suitable for the growth portion of an investor’s portfolio, balancing it with more conservative investments.

What should I consider before investing in VDHG or DHHF?

Consider your risk tolerance, investment goals, timeframe, the ETFs’ fees, historical performance, and how they align with your existing portfolio. It’s also important to keep in mind that ETFs should be viewed as long-term investments.

Can VDHG and DHHF help me diversify my portfolio internationally?

Absolutely. Both ETFs provide international exposure, with VDHG including global bonds and DHHF focusing on global equities, which can help diversify your portfolio geographically.

How can I track the performance of my investment in VDHG or DHHF?

You can track the performance through your brokerage platform, the Australian Securities Exchange (ASX), or directly from the fund providers’ websites.

What is the minimum investment for VDHG and DHHF?

The minimum investment is typically the price of one share when buying through a brokerage. For direct investment platforms, such as Vanguard’s Personal Investor platform, there may be different minimum investment requirements.

How do currency fluctuations affect my investment in VDHG or DHHF?

Currency fluctuations can affect the value of international investments. VDHG hedges some of its investments to mitigate this risk, while DHHF may be more exposed to currency risk due to its global equity focus.

Should I choose VDHG or DHHF based on past performance?

Past performance should not be the sole factor in your decision. Consider the overall investment strategy, risk tolerance, and how each ETF fits into your financial goals.

What are the tax implications of investing in VDHG or DHHF?

The tax implications depend on individual circumstances, including residency status and whether dividends are reinvested. It’s advisable to consult with a tax advisor to understand the specific implications for you.

Expand Your Financial Knowledge: Visit our Personal Finance section for essential tips, delve into Property Investing for the latest market insights, or explore our comprehensive Resources for educational articles and tools. If you’re interested in the stock market, our Shares & ETFs section offers a range of options to suit your investment goals. Dive into these areas to enhance your financial understanding and decision-making.

Disclaimer

Not a Licensed Financial Advisor

The information and insights provided in this document are intended solely for educational and informational purposes. It’s imperative to understand that I am not a licensed financial advisor, tax expert, or investment strategist. The contents herein are crafted to offer a general overview and should not be construed as personalized financial advice.

Affiliate Disclosure: Some of the links on this blog may be affiliate links. This means if you click on the link and purchase a product or service, I may receive a commission at no additional cost to you. I only recommend products or services that I believe in, and that may be helpful to my readers.

Before making any financial decisions or embarking on investment ventures, it’s crucial to consult with a professional financial advisor or a certified tax consultant who is well-equipped to understand your unique financial landscape. Engaging with a licensed professional ensures that the advice you receive is tailored to your specific financial goals, risk tolerance, and tax obligations, adhering to the compliance and guidelines established by regulatory authorities, including the Australian Taxation Office (ATO) and other relevant bodies.

Financial markets are complex and dynamic and involve various degrees of risk. Therefore, thorough due diligence and professional guidance are essential to navigate these waters effectively. This content does not represent the opinions or endorsements of any financial institutions or regulatory agencies. Remember, the responsibility for financial decisions lies with the individual, and seeking qualified advice is the best step towards informed decision-making and achieving financial objectives.