Discover 2024’s top investment opportunity in Australia with BetaShares’ new Nasdaq ETFs, ideal for beginners and seasoned investors looking for solid returns without high risk.

BetaShares, a leader in the financial market, has recently launched two exciting Nasdaq exchange-traded funds (ETFs) on the Australian Securities Exchange (ASX). These new offerings, the BetaShares Nasdaq Next Gen 100 ETF (ASX: JNDQ) and the BetaShares Nasdaq 100 Equal Weight ETF (ASX: QNDQ), present unique opportunities for investors looking to diversify their portfolios with exposure to U.S. markets.

Introducing the BetaShares Nasdaq Next Gen 100 ETF (ASX: JNDQ)

Overview of JNDQ

The BetaShares Nasdaq Next Gen 100 ETF targets the Nasdaq Next Generation 100 Index®, comprising the 100 largest Nasdaq-listed non-financial companies beyond the Nasdaq-100. This fund is designed for investors seeking to capture the growth of today’s emerging companies which are poised to become tomorrow’s market leaders.

Investment Advantages of JNDQ

- Emerging Leaders: JNDQ focuses on innovative firms that are in the early stages of their growth trajectory but have potential to scale significantly.

- Diversification: The ETF offers broad diversification, with a portfolio where no single company’s weight exceeds 4%, thereby reducing individual stock risk.

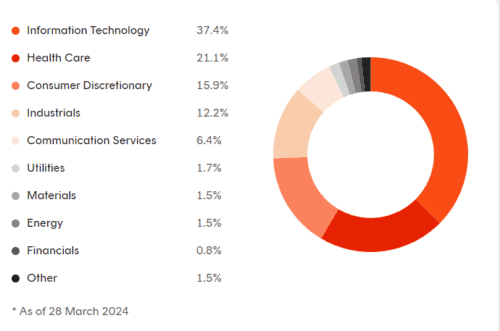

- Sector Exposure: While technology companies dominate the fund, substantial investments in healthcare, industrials, and consumer discretionary sectors ensure a balanced exposure.

Early Access to Growth Potential

Many of the companies in JNDQ’s index are in the early stages of their development, providing investors with the chance to invest in these companies at an earlier point in their growth journey. The fund offers meaningful weightings in companies with significant growth potential.

Diversification Benefits

JNDQ’s index offers broad diversification across companies and sectors, with no single security weighing more than 4%. While technology remains the most heavily represented sector, the index also provides substantial exposure to healthcare, consumer discretionary, and industrials, resulting in a more diversified overall portfolio.

Leading Holdings in JNDQ

Among the top companies in JNDQ’s portfolio are industry pioneers such as Super Micro Computer Inc., known for its advanced computing solutions, and Monolithic Power Systems Inc., a leader in integrated power solutions. This selection underpins the ETF’s focus on sectors that are pivotal to technological and industrial advancements.

Top 10 Holding for JNDQ

| Name | Weight (%) |

|---|---|

| SUPER MICRO COMPUTER INC | 3.7% |

| MONOLITHIC POWER SYSTEMS INC | 2.1% |

| TRACTOR SUPPLY CO | 1.9% |

| EBAY INC | 1.8% |

| ICON PLC | 1.7% |

| ALIGN TECHNOLOGY INC | 1.6% |

| AXON ENTERPRISE INC | 1.6% |

| WESTERN DIGITAL CORP | 1.6% |

| STEEL DYNAMICS INC | 1.5% |

| PTC INC | 1.5% |

Sector Allocation for JNDQ

BetaShares Nasdaq 100 Equal Weight ETF (ASX: QNDQ)

Overview of QNDQ

The BetaShares Nasdaq 100 Equal Weight ETF seeks to replicate the performance of the Nasdaq-100 Equal Weighted Index. Each company in this index is equally weighted, providing a unique take on investing in some of the largest and most influential non-financial companies on the Nasdaq.

Why Choose QNDQ?

- Equal Weighting: Each stock in the QNDQ index has an equal 1% weight at each rebalance, minimizing the impact of large swings in any single stock.

- Comprehensive Market Access: Investors gain exposure to a wide array of sectors, including technology, healthcare, and consumer services, reflecting a cross-section of the modern economic landscape.

- Diversification Benefits: This ETF is particularly appealing for those looking to diversify away from the heavily financial and mining-oriented Australian market.

Access to the New Economy

QNDQ’s portfolio includes prominent companies at the forefront of technological innovation, such as Amazon, Apple, Alphabet, Microsoft, Tesla, and Nvidia. These companies are revolutionizing various aspects of our lives and driving the growth of the new economy.

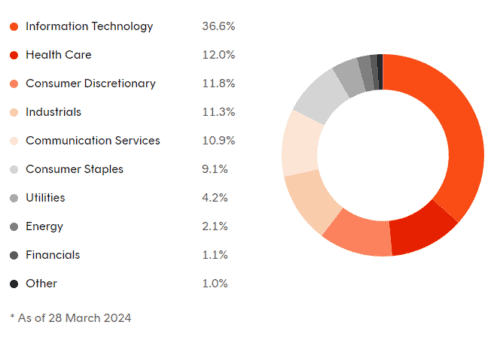

Diversification and Low Concentration Risk

Each stock in QNDQ’s index has a 1% weighting, resulting in low stock concentration risk. While technology remains the dominant sector, the fund also provides exposure to healthcare, consumer discretionary, and industrials, offering a more diversified portfolio overall.

Top Companies in QNDQ

QNDQ includes prominent companies like Apple, Amazon, and Microsoft, ensuring that investors are part of the growth story of these tech giants. This ETF’s balanced approach helps mitigate risks associated with market fluctuations.

Top Holding for QNDQ

| Name | Weight (%) |

|---|---|

| MICRON TECHNOLOGY INC | 1.2% |

| CONSTELLATION ENERGY CORP | 1.2% |

| KRAFT HEINZ CO/THE | 1.1% |

| KEURIG DR PEPPER INC | 1.1% |

| DIAMONDBACK ENERGY INC | 1.1% |

| TRADE DESK INC/THE | 1.1% |

| CINTAS CORP | 1.1% |

| PEPSICO INC | 1.1% |

| DATADOG INC | 1.1% |

| META PLATFORMS INC | 1.1% |

Sector Allocation for QNDQ

Investment Considerations

Investing in JNDQ and QNDQ provides a gateway to sectors that are underrepresented in the Australian market, such as advanced technology and consumer digital services. These ETFs offer a strategic complement to a well-rounded investment portfolio, providing both growth potential through emerging companies and stability via established industry leaders.

Portfolio Diversification for Australian Investors

QNDQ allows Australian investors to diversify their portfolios by gaining exposure to sectors that are underrepresented in the Australian share market, such as technology. This can potentially benefit investors who have a relatively large allocation to sectors like financials and mining.

Both JNDQ and QNDQ complement Betashares’ existing Nasdaq 100 ETF (ASX: NDQ), which recently surpassed AUD 4 billion in assets under management. With these new offerings, investors can gain exposure to a broader range of innovative companies listed on the Nasdaq exchange, catering to various investment objectives and risk profiles.

As with any investment, risks are associated with an investment in JNDQ and QNDQ, including market risk, country risk, currency risk, and index methodology risk. Investors are encouraged to carefully consider the Product Disclosure Statement and Target Market Determination available on Betashares’ website before making any investment decisions.

Conclusion: A Smart Choice for Forward-Thinking Investors

BetaShares’ latest Nasdaq ETFs, JNDQ and QNDQ, are crafted to meet the needs of investors who aim for growth and appreciate the importance of portfolio diversification. These funds not only offer exposure to the expansive U.S. market but also enable participation in the evolution of global industry leaders and innovators. Whether you are an experienced investor or new to the stock market, these ETFs represent a thoughtful addition to any investment strategy focused on long-term capital growth and risk management.

Frequently Asked Questions (FAQs)

What is the difference between JNDQ and QNDQ?

JNDQ (Betashares Nasdaq Next Gen 100 ETF) provides exposure to the 100 largest non-financial Nasdaq-listed companies outside of the Nasdaq-100 Index. These are emerging, innovative companies with the potential to become future leaders.

QNDQ (Betashares Nasdaq 100 Equal Weight ETF) tracks an equal-weighted portfolio of the 100 largest non-financial companies in the Nasdaq-100 Index, including well-established tech giants.

What are the benefits of equal weighting in QNDQ?

By equal-weighting the Nasdaq-100 companies, QNDQ offers lower concentration risk compared to a market-cap-weighted fund. This means it is not overly exposed to a few mega-cap tech stocks. It also provides diversification across sectors like healthcare and consumer discretionary.

How are the companies selected for JNDQ’s index?

The Nasdaq Next Generation 100 Index selects the 100 largest non-financial Nasdaq-listed companies outside the Nasdaq-100 Index based on market capitalization. This focuses on up-and-coming companies in growth sectors.

What is the minimum investment for these BetaShares Nasdaq ETFs ?

You can start investing in JNDQ and QNDQ with any amount typically acceptable by your broker for ASX-traded funds, making them accessible to a wide range of investors.

How often do these BetaShares Nasdaq ETFs rebalance?

Both ETFs rebalance their portfolios regularly in accordance with their index guidelines to ensure alignment with their strategic investment objectives.

Can I include these BetaShares Nasdaq ETFs in my self-managed super fund (SMSF)?

Yes, both JNDQ and QNDQ are suitable for inclusion in a self-managed super fund, offering SMSF trustees an excellent opportunity to diversify their investment portfolios.

Where can I find more information on these BetaShares Latest Nasdaq ETFs?

Additional details, including the Product Disclosure Statements and Target Market Determinations, are available on the BetaShares website. Investors are encouraged to review these documents to understand the ETFs’ investment strategies and associated risks fully.

What are some examples of companies in JNDQ and QNDQ?

Top holdings in JNDQ include Super Micro Computer, Monolithic Power Systems, Tractor Supply Co, and eBay. Examples in QNDQ are Micron Technology, Constellation Energy, Kraft Heinz, and Meta Platforms.

What risks should investors consider?

Key risks include market risk, country/concentration risk, currency risk, and index methodology risks. The funds should be viewed as part of a diversified portfolio based on an investor’s circumstances and risk tolerance.

Expand Your Financial Knowledge: Visit our Personal Finance section for essential tips, delve into Property Investing for the latest market insights, or explore our comprehensive Resources for educational articles and tools. If you’re interested in the stock market, our Shares & ETFs section offers a range of options to suit your investment goals. Dive into these areas to enhance your financial understanding and decision-making.

Disclaimer

Not a Licensed Financial Advisor

The information and insights provided in this document are intended solely for educational and informational purposes. It’s imperative to understand that I am not a licensed financial advisor, tax expert, or investment strategist. The contents herein are crafted to offer a general overview and should not be construed as personalized financial advice.

Affiliate Disclosure: Some of the links on this blog may be affiliate links. This means if you click on the link and purchase a product or service, I may receive a commission at no additional cost to you. I only recommend products or services that I believe in, and that may be helpful to my readers.

Before making any financial decisions or embarking on investment ventures, it’s crucial to consult with a professional financial advisor or a certified tax consultant who is well-equipped to understand your unique financial landscape. Engaging with a licensed professional ensures that the advice you receive is tailored to your specific financial goals, risk tolerance, and tax obligations, adhering to the compliance and guidelines established by regulatory authorities, including the Australian Taxation Office (ATO) and other relevant bodies.

Financial markets are complex and dynamic and involve various degrees of risk. Therefore, thorough due diligence and professional guidance are essential to navigate these waters effectively. This content does not represent the opinions or endorsements of any financial institutions or regulatory agencies. Remember, the responsibility for financial decisions lies with the individual, and seeking qualified advice is the best step towards informed decision-making and achieving financial objectives.