Today, we will explore Hedged vs. Unhedged ETFs, but first, let’s have a quick glance at what ETFs are. Exchange-traded funds (ETFs) allow investors to buy a collection of stocks, bonds, or other assets, and they trade on stock exchanges. ETFs can help diversify portfolios and are often more affordable than buying individual securities.

When investing in international ETFs, you encounter currency risks. This is where the concepts of hedged and unhedged ETFs come into play. Understanding these can help you make better investment decisions.

What is a Hedged ETF?

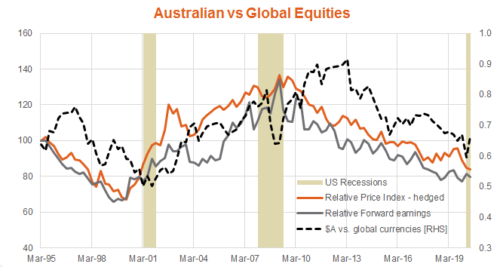

A hedged ETF is designed to protect investors from changes in currency exchange rates. When you invest in international markets, the value of your investment can be affected by fluctuations in currency values. For example, if you live in Australia and invest in a U.S. stock ETF, changes between the U.S. dollar and the Australian dollar can impact your returns.

To manage this, hedged ETFs use financial strategies to “lock in” the exchange rate between the two currencies. This means that no matter how the currency values change, your investment remains stable.

Think of it like buying a fixed-price ticket for a concert. Whether ticket prices go up or down in the future, your price is set and protected. Similarly, a hedged ETF locks in a currency exchange rate, so your investment isn’t affected by future changes.

How Does a Hedged ETF Work?

Imagine you invest in a U.S. stock ETF, but you live in Australia. The value of your investment depends not only on how well the U.S. stocks perform but also on the exchange rate between the U.S. dollar (USD) and the Australian dollar (AUD). If the USD gets stronger compared to the AUD, your investment’s value in AUD increases. But if the USD gets weaker, your investment’s value in AUD decreases.

A hedged ETF removes this uncertainty by using financial tools to fix the exchange rate at a certain level. So, if the exchange rate changes, it doesn’t impact the value of your investment.

Example of a Hedged ETF

Consider the Betashares Gold Bullion ETF – Currency Hedged (QAU). This ETF invests in gold but ensures that the investment is protected against changes in the USD/AUD exchange rate. If the value of the USD changes compared to the AUD, it won’t affect your returns because the exchange rate has been “locked in.”

By using a hedged ETF, you can focus on the performance of the underlying investments (like stocks or gold) without worrying about currency changes impacting your returns.

In summary, a hedged ETF aims to provide more predictable and stable returns for international investments by protecting against currency fluctuations. This makes it a suitable choice for investors who prefer stability and want to avoid the risks associated with changing exchange rates.

Types of Hedged ETFs

1. Currency Hedged ETFs

These ETFs protect your investment from changes in currency exchange rates. For example, the Betashares Gold Bullion ETF – Currency Hedged (QAU) allows Australian investors to invest in gold without worrying about changes in the value of the U.S. dollar. It converts the gold price into Australian dollars, keeping your investment stable despite currency fluctuations.

2. Interest Rate Hedged ETFs

Interest Rate Hedged ETFs help protect against changes in interest rates. These are often used by bond ETFs. For instance, if interest rates rise, the value of bonds can fall. An interest rate hedged ETF aims to keep your returns stable even when interest rates change.

3. Commodity Hedged ETFs

Commodity Hedged ETFs protect against price changes in commodities like gold, oil, or agricultural products. For example, some gold ETFs hedge the price of gold to protect investors from fluctuations in gold prices. This means that even if the price of gold changes, your investment remains stable.

4. Equity Hedged ETFs

Equity Hedged ETFs use strategies to protect against declines in the stock market. One example is the ProShares Short S&P500 (SH), which is designed to go up in value when the S&P 500 index goes down. This kind of ETF can help balance your portfolio during stock market downturns.

Benefits of Hedged ETFs

- Protection from Currency Fluctuations: Hedged ETFs help keep your investment returns stable by locking in exchange rates. This means that changes in currency values won’t impact your returns.

- Reduced Risk: Hedged ETFs provide more predictable returns, making them a good choice for cautious investors who want to avoid surprises.

- Stable Income: These ETFs are beneficial for people who need a steady income, like retirees. They can help ensure that your returns are consistent and reliable.

Drawbacks of Hedged ETFs

- Higher Fees: Using hedging strategies costs money, leading to higher management fees for hedged ETFs. This can eat into your overall returns.

- Missed Opportunities: When you hedge against currency fluctuations, you won’t benefit if the currency moves in a favourable direction. This means you might miss out on potential gains.

- Potential Underperformance: In situations where currency conditions are favourable, hedged ETFs might not perform as well as unhedged ETFs. This could result in lower returns compared to unhedged options.

What is an Unhedged ETF?

An unhedged ETF is a type of exchange-traded fund that does not take steps to protect against currency risk. This means that when you invest in an unhedged ETF, your returns are directly affected by changes in currency exchange rates.

How Does an Unhedged ETF Work?

When you invest in international markets through an unhedged ETF, the value of your investment is influenced by both the performance of the underlying assets and the changes in the exchange rate between your home currency and the foreign currency. For instance, if you are an Australian investor buying a U.S. stock ETF, your investment is affected by the performance of U.S. stocks and the exchange rate between the Australian dollar (AUD) and the U.S. dollar (USD).

Let’s break this down:

- If the AUD Weakens: If the Australian dollar weakens against the U.S. dollar, the value of your U.S. stock ETF will increase when converted back to AUD. This is because you will get more AUD for each USD. In this scenario, an unhedged ETF can lead to higher returns.

- If the AUD Strengthens: Conversely, if the Australian dollar strengthens against the U.S. dollar, the value of your U.S. stock ETF will decrease when converted back to AUD. You will get fewer AUD for each USD. This can lead to higher losses with an unhedged ETF.

Example of an Unhedged ETF

Consider the Global X Physical Gold ETF (GOLD). This ETF invests in gold priced in U.S. dollars but does not hedge against changes in the USD/AUD exchange rate. If the Australian dollar weakens, the value of the gold ETF in AUD will increase, and if the Australian dollar strengthens, the value will decrease.

Types of Unhedged ETFs

1. Standard Unhedged ETFs

Standard unhedged ETFs invest in foreign assets without any protection against currency risk. This means that the returns on these ETFs are directly influenced by the performance of the underlying assets and the changes in the exchange rate between the home currency and the foreign currency.

- Example: The Global X Physical Gold ETF (GOLD) invests in gold priced in U.S. dollars. Since it does not hedge against changes in the USD/AUD exchange rate, the value of this ETF for an Australian investor will fluctuate based on both the price of gold and the USD/AUD exchange rate.

2. Sector-Specific Unhedged ETFs

Sector-specific unhedged ETFs focus on particular industries or sectors, such as technology, healthcare, or energy, without hedging against currency movements. These ETFs allow investors to target specific areas of the market while accepting the risks associated with currency fluctuations.

- Example: A technology-focused unhedged ETF might invest in leading tech companies from around the world. While the performance of these companies will drive the ETF’s returns, changes in currency exchange rates will also impact the value of the investment for an investor whose home currency differs from the currency in which the tech companies are valued.

Benefits of Unhedged ETFs

1. Potential for Higher Returns

Unhedged ETFs can offer higher returns if your home currency falls in value compared to the foreign currency of the ETF’s investments. This is because when the home currency depreciates, the value of the foreign investments increases when converted back to the home currency.

- Example: If the Australian dollar (AUD) weakens against the U.S. dollar (USD), the value of a U.S. stock ETF in AUD will increase, potentially leading to higher returns for Australian investors.

2. Lower Fees

Without the additional costs associated with hedging strategies, unhedged ETFs typically have lower management fees. This can be beneficial for investors looking to minimize expenses and maximize net returns.

- Example: An unhedged global equity ETF will generally have lower fees compared to its hedged counterpart, as it does not incur costs related to managing currency risk.

3. Suitable for Long-Term Investors

Over the long term, currency fluctuations tend to balance out. This means that long-term investors might not need to hedge against currency risk, as the ups and downs of exchange rates could even out over time.

- Example: An investor with a 10-year investment horizon might choose an unhedged ETF, betting that currency movements will not significantly impact the overall returns during this period.

Drawbacks of Unhedged ETFs

1. Full Exposure to Currency Risks

Unhedged ETFs are fully exposed to currency movements, making them more volatile. The value of these ETFs can fluctuate significantly based on changes in exchange rates.

- Example: If the Australian dollar strengthens against the U.S. dollar, the value of U.S. stock ETFs in AUD will decrease, leading to potential losses for Australian investors.

2. Potential for Higher Losses

If your home currency appreciates, the value of foreign investments in an unhedged ETF will decrease when converted back to the home currency. This can result in higher losses compared to hedged ETFs.

- Example: If the AUD strengthens, the value of an unhedged ETF investing in U.S. stocks will drop when its value is calculated in AUD.

3. Increased Volatility

Unhedged ETFs can experience more significant fluctuations in value due to their exposure to currency risk. This increased volatility can be a concern for investors who prefer more stable returns.

- Example: An unhedged ETF investing in European stocks will not only be affected by the performance of the stocks but also by the fluctuations in the exchange rate between the euro and the investor’s home currency. This can lead to unpredictable swings in the ETF’s value.

Comparison of Hedged vs Unhedged ETFs

Performance Comparison

Hedged ETFs and unhedged ETFs can have different performance outcomes due to their approach to handling currency risks.

- Hedged ETFs: These aim to reduce the impact of currency fluctuations, which can make their returns more stable and predictable. For example, consider two global share ETFs: IOO (unhedged) and IHOO (hedged). While both invest in a similar set of international stocks, IHOO uses hedging to protect against changes in currency exchange rates. This means that the performance of IHOO will be more consistent, as it is not affected by the ups and downs of the exchange rates between the investor’s home currency and the foreign currencies.

- Unhedged ETFs: These do not protect against currency fluctuations, meaning their returns can vary more widely. The value of an unhedged ETF like IOO can be significantly influenced by changes in currency exchange rates. If the home currency weakens against the foreign currency, the value of the ETF increases, and if the home currency strengthens, the value of the ETF decreases. This can lead to higher returns during favourable currency movements but also higher losses during unfavourable ones.

Cost Comparison

The fees associated with hedged and unhedged ETFs also differ.

- Hedged ETFs: Hedging strategies involve additional financial transactions and management efforts, which result in higher fees. For instance, the hedged version of a global share ETF, IHOO, has a fee of 0.43%. These fees cover the costs of implementing and managing the hedging strategies that stabilize the currency exchange rates.

- Unhedged ETFs: These typically have lower fees because they do not incur the additional costs of hedging. For example, the unhedged version of the same global share ETF, IOO, has a lower fee of 0.40%. This small difference in fees might seem negligible in the short term, but over the long term, it can impact the overall returns of the investment due to the compounding effect of fees.

Risk and Return Profile

The risk and return profiles of hedged and unhedged ETFs cater to different types of investors.

- Hedged ETFs: These are designed to reduce currency risk, making them a suitable choice for risk-averse investors. By eliminating the uncertainty associated with currency fluctuations, hedged ETFs offer more predictable and stable returns. This makes them a good option for investors who prioritize stability and are concerned about the impact of currency movements on their investments.

- Unhedged ETFs: These come with higher risk due to exposure to currency fluctuations but can potentially offer higher returns if the currency movements are favorable. For example, if an investor’s home currency weakens, the value of the unhedged ETF can increase, leading to higher returns. However, this also means that if the home currency strengthens, the value of the investment can decrease, leading to higher losses. Unhedged ETFs are better suited for investors with a higher risk tolerance who are willing to accept the volatility in exchange for the possibility of higher returns.

Making the Choice

The choice between hedged and unhedged ETFs depends on your investment goals, risk tolerance, and market outlook.

- Risk-Averse Investors: If you prefer stability and want to minimize the impact of currency fluctuations, hedged ETFs might be the better choice. They offer more predictable returns and reduce the risk associated with currency movements.

- Risk-Tolerant Investors: If you are comfortable with higher volatility and are looking for the potential for higher returns, unhedged ETFs might be more suitable. They allow you to benefit from favourable currency movements but also expose you to the risk of higher losses if the currency movements are unfavourable.

Hedged ETFs provide stability and reduced risk, making them ideal for conservative investors, while unhedged ETFs offer the potential for higher returns at the cost of increased volatility, making them suitable for more adventurous investors. Your choice should align with your overall investment strategy and financial goals.

When to Buy Hedged vs. Unhedged ETFs

Investment Goals and Time Horizon

Your investment goals and the length of time you plan to hold your investments are crucial factors in deciding between hedged and unhedged ETFs.

- Short-Term Investors: If your investment horizon is short, meaning you plan to use the funds within a few years, you might prioritize stability and predictability. In this case, hedged ETFs could be a better choice. Hedged ETFs aim to reduce the volatility caused by currency fluctuations, providing more stable returns. This stability can be especially important for short-term goals, such as saving for a down payment on a house or funding a child’s education.

- Long-Term Investors: If you have a long-term investment horizon, meaning you plan to hold your investments for many years, you might be more comfortable with taking on additional risk in exchange for the potential of higher returns. Unhedged ETFs, while more volatile in the short term, can offer higher returns over time if currency movements are favourable. Long-term investors can often ride out the short-term volatility and benefit from the overall growth in the value of the investments.

Market Conditions and Currency Outlook

The current state of the economy and the outlook for currency movements can also influence your decision.

- Strong Home Currency: If your home currency is currently strong compared to other currencies, hedged ETFs can protect you from potential losses if your home currency weakens in the future. A strong home currency can make foreign investments more expensive, and hedging can help maintain the value of your investments by locking in favourable exchange rates.

- Weak Home Currency: If your home currency is weak, unhedged ETFs can benefit from the potential depreciation of your home currency. When the value of your home currency falls, the value of your foreign investments, when converted back to your home currency, increases. This can lead to higher returns for investors who hold unhedged ETFs.

Investor Profile and Risk Tolerance

Your personal risk tolerance and investment profile are key factors in choosing between hedged and unhedged ETFs.

- Risk-Averse Investors: If you prefer to avoid risk and seek more stable and predictable returns, hedged ETFs are likely the better option. These ETFs reduce the impact of currency fluctuations, providing a smoother investment experience. Hedged ETFs are suitable for investors who prioritize stability, such as retirees or those nearing retirement, who rely on their investments for a steady income.

- Risk-Tolerant Investors: If you are comfortable with higher levels of risk and the potential for greater volatility in your investment returns, unhedged ETFs might be more appropriate. These ETFs allow you to take advantage of favourable currency movements, which can lead to higher returns. However, this also means accepting the possibility of higher losses if currency movements are unfavourable. Risk-tolerant investors might include younger individuals with a long investment horizon or those with a higher appetite for risk in pursuit of greater rewards.

Conclusion

In summary, the choice between hedged and unhedged ETFs depends on your investment goals, time horizon, current market conditions, and personal risk tolerance.

- Short-term investors seeking stability should consider hedged ETFs for their ability to provide more predictable returns.

- Long-term investors who can handle more risk might prefer unhedged ETFs for their potential to offer higher returns over time.

- When the home currency is strong, hedged ETFs can protect against potential currency depreciation, while a weak home currency can make unhedged ETFs more attractive due to the potential for higher returns.

- Risk-averse investors will find hedged ETFs more suitable for their need for stability, while risk-tolerant investors can benefit from the higher risk and potentially higher returns of unhedged ETFs.

FAQ: Hedged vs. Unhedged ETFs

Is Hedged or Unhedged Better?

The answer depends on your investment goals, risk tolerance, and market outlook. Hedged ETFs provide more stability and reduce currency risk, making them suitable for risk-averse investors. Unhedged ETFs can offer higher returns if currency movements are favourable, but they come with higher risk and volatility.

What Does It Mean if an ETF is Hedged?

A hedged ETF uses financial strategies to protect against currency fluctuations. This means the ETF locks in the exchange rate, reducing the impact of currency changes on your investment returns.

Is IVV Hedged or Unhedged?

The iShares S&P 500 ETF (IVV) is an unhedged ETF. It invests in U.S. stocks without protecting against currency fluctuations, meaning its returns are affected by changes in the USD/AUD exchange rate for Australian investors.

What Does “Unhedged Fund” Mean?

An unhedged fund does not take steps to protect against currency risk. It fully exposes investors to changes in exchange rates, which can lead to higher returns if the home currency depreciates or higher losses if the home currency appreciates.

When to Buy Hedged vs. Unhedged ETFs?

Buy hedged ETFs if you need stable, predictable returns and want to minimize currency risk. Opt for unhedged ETFs if you can handle more risk and potential volatility for the chance of higher returns, especially over the long term.

Are Vanguard ETFs Currency Hedged?

Some Vanguard ETFs are currency hedged, while others are not. It depends on the specific ETF. Always check the ETF’s prospectus or official website for details on whether it is hedged.

What Are the Risks of Currency Hedging ETF?

Currency hedging can protect against unfavourable currency movements but comes with higher management fees. Additionally, if currency movements are favourable, a hedged ETF may miss out on potential gains.

What is the Difference Between Hedged and Unhedged ETFs?

Hedged ETFs use strategies to protect against currency fluctuations, offering more stable returns. Unhedged ETFs do not protect against currency risk, leading to higher volatility but the potential for higher returns if currency movements are favourable.

Are Hedge Funds Better Than ETFs?

Hedge funds and ETFs serve different purposes. Hedge funds are actively managed, often use complex strategies, and are less accessible to average investors due to higher fees and minimum investment requirements. ETFs are more accessible, usually have lower fees, and offer easy diversification.

How Do You Know if an ETF is Hedged?

Check the ETF’s name, description, and prospectus. Hedged ETFs often include “hedged” in their name and clearly state their currency hedging strategy in their documentation. The ETF provider’s website will also provide details on whether the ETF is hedged.

Why Buy Hedged ETFs?

Buy hedged ETFs to protect against currency risk, achieve more predictable returns, and reduce investment volatility. They are especially beneficial for risk-averse investors and those who need a stable income, such as retirees.

Are Hedged Funds Worth It?

Hedged funds can be worth it for investors seeking stability and protection against currency risk. However, they come with higher fees and may underperform in favourable currency conditions. Assess your risk tolerance and investment goals before deciding.

What is Hedged vs. Unhedged in Australia?

In Australia, hedged ETFs protect against currency fluctuations between the Australian dollar (AUD) and foreign currencies, providing more stable returns. Unhedged ETFs expose investors to currency risk, which can lead to higher returns if the AUD weakens but higher losses if it strengthens.

Are Hedge Funds More Risky?

Hedge funds can be riskier than ETFs because they often use leverage, short selling, and other complex strategies. They also have higher fees and less transparency compared to ETFs. Assess your risk tolerance and investment goals before investing in hedge funds.

How Does Currency Hedging Work in ETFs?

Currency hedging in ETFs involves using financial instruments to lock in exchange rates between currencies. This reduces the impact of currency fluctuations on the ETF’s returns, providing more stable and predictable performance for investors.

Can You Switch Between Hedged and Unhedged ETFs?

Yes, you can switch between hedged and unhedged ETFs based on your investment strategy and market outlook. Consult with a financial advisor to determine the best time and approach for switching between these types of ETFs.

Do All ETFs Offer Hedged Versions?

Not all ETFs have hedged versions. It depends on the ETF provider and the specific market or sector the ETF targets. Check the ETF’s prospectus or provider’s website for information on available hedged and unhedged options.

What Factors Should I Consider When Choosing Between Hedged and Unhedged ETFs?

Consider your investment goals, risk tolerance, investment horizon, and the current and expected future state of currency markets. Evaluating these factors can help you decide whether a hedged or unhedged ETF is more suitable for your portfolio.

How Do Hedged ETFs Affect My Tax Situation?

Hedged ETFs may have different tax implications compared to unhedged ETFs due to the transactions involved in hedging strategies. It’s important to consult with a tax advisor to understand the specific tax effects of investing in hedged ETFs.

Are There Sector-Specific Hedged and Unhedged ETFs?

Yes, there are sector-specific hedged and unhedged ETFs available. These ETFs focus on specific industries such as technology, healthcare, or energy and can be either hedged to protect against currency risk or unhedged to fully expose investors to currency fluctuations.

Expand Your Financial Knowledge: Visit our Personal Finance section for essential tips, delve into Property Investing for the latest market insights, or explore our comprehensive Resources for educational articles and tools. If you’re interested in the stock market, our Shares & ETFs section offers a range of options to suit your investment goals. Dive into these areas to enhance your financial understanding and decision-making.

Disclaimer

Estimations for Illustrative Purposes: The GST calculations generated by this Australian GST Calculator are approximations intended for educational and illustrative purposes only. While we strive for accuracy, actual GST liabilities may differ due to specific circumstances or changes in tax laws.

Excludes Other Considerations: This Australian GST Calculator focuses solely on Goods and Services Tax (GST) estimations. It does not incorporate other potential fiscal obligations, such as additional taxes, levies, or deductions that may impact the total amount payable when managing your finances or business operations.

Not Professional Financial Advice: The use of this GST calculator does not constitute financial advice. It is not intended to replace professional consultation and should not be the only factor in making financial decisions. For personalized financial guidance, we recommend seeking advice from a qualified tax consultant or financial advisor.

Use at Your Discretion: By using this Australian GST Calculator, you understand and agree that the outcomes are estimates and that your specific tax situation may vary. Any actions taken based on the calculator’s results are done at your own discretion and risk.

Not a Licensed Financial Advisor

The information and insights provided in this document are intended solely for educational and informational purposes. It’s imperative to understand that I am not a licensed financial advisor, tax expert, or investment strategist. The contents herein are crafted to offer a general overview and should not be construed as personalized financial advice.

Affiliate Disclosure: Some of the links on this blog may be affiliate links. This means if you click on the link and purchase a product or service, I may receive a commission at no additional cost to you. I only recommend products or services that I believe in, and that may be helpful to my readers.

Before making any financial decisions or embarking on investment ventures, it’s crucial to consult with a professional financial advisor or a certified tax consultant who is well-equipped to understand your unique financial landscape. Engaging with a licensed professional ensures that the advice you receive is tailored to your specific financial goals, risk tolerance, and tax obligations, adhering to the compliance and guidelines established by regulatory authorities, including the Australian Taxation Office (ATO) and other relevant bodies.

Financial markets are complex and dynamic and involve various degrees of risk. Therefore, thorough due diligence and professional guidance are essential to navigate these waters effectively. This content does not represent the opinions or endorsements of any financial institutions or regulatory agencies. Remember, the responsibility for financial decisions lies with the individual, and seeking qualified advice is the best step towards informed decision-making and achieving financial objectives.