Read our HACK ETF review to discover the benefits, performance, and future growth potential of the Betashares Global Cybersecurity ETF. Invest in leading cybersecurity firms.

Introduction

The Betashares Global Cybersecurity ETF (HACK) is a specialized exchange-traded fund (ETF) that offers investors an opportunity to gain exposure to the rapidly growing global cybersecurity sector. This ETF is designed to track the performance of the Nasdaq Consumer Technology Association Cybersecurity Index, which includes leading companies involved in the development and management of cybersecurity solutions.

As cybercrime continues to escalate, the importance of robust cybersecurity measures has never been more critical. Businesses and governments are increasingly investing in cybersecurity to protect sensitive data and infrastructure from cyber threats. This surge in demand is expected to drive significant growth in the cybersecurity industry over the coming years.

HACK provides a convenient and cost-effective way for investors to tap into this dynamic sector. By investing in HACK, you can gain exposure to a diversified portfolio of global cybersecurity companies, ranging from established industry leaders to innovative emerging players. This diversification helps mitigate the risks associated with investing in individual stocks while capturing the growth potential of the entire sector.

What is the HACK ETF?

The HACK ETF, or Betashares Global Cybersecurity ETF, is an investment product designed to give investors access to the cybersecurity sector through a diversified portfolio of companies. This ETF aims to replicate the performance of the Nasdaq Consumer Technology Association Cybersecurity Index, which includes some of the leading companies in the cybersecurity industry worldwide.

Index Composition and Focus

The Nasdaq Consumer Technology Association Cybersecurity Index is specifically tailored to include businesses that are at the forefront of cybersecurity innovation and services. This index focuses on companies involved in a wide range of cybersecurity-related activities, including:

- Development of Security Software: Companies that create and manage software solutions designed to protect computer systems, networks, and mobile devices from cyber threats.

- Management of Security Protocols: Businesses that establish and maintain security protocols to safeguard data and ensure secure communication channels.

- Provision of Cybersecurity Services: Firms that offer consulting, managed security services, and incident response services to help organizations defend against cyberattacks.

Types of Companies in the Index

The index includes a variety of companies, ranging from large, well-established firms to smaller, innovative players. These companies are involved in different aspects of cybersecurity, such as:

- Systems Software Providers: Companies that develop software solutions for protecting operating systems and applications.

- Communications Equipment Manufacturers: Businesses that produce hardware essential for secure communications.

- Consulting and Research Services: Firms that offer expertise and research to help organizations improve their cybersecurity measures.

- Internet Services and Infrastructure Companies: Providers of essential internet services and infrastructure with a focus on security.

- Semiconductor Companies: Businesses that manufacture chips and other components vital for secure computing.

- IT Consulting and Other Services: Firms offering specialized IT consulting services with a focus on cybersecurity.

Investment Benefits

Investing in the HACK ETF offers several benefits:

- Diversified Exposure: By investing in a wide range of companies within the cybersecurity sector, the ETF reduces the risk associated with investing in individual stocks.

- Global Reach: The HACK ETF provides exposure to cybersecurity companies from various parts of the world, including the United States, Canada, India, Britain, and Israel.

- Cost-Effective Access: The ETF structure allows investors to gain exposure to multiple companies in one trade, often at a lower cost compared to buying individual stocks.

- Growth Potential: With cyber threats on the rise, the demand for cybersecurity solutions is expected to grow, potentially leading to strong performance for companies in this sector.

Under-Representation on the ASX

Many leading cybersecurity companies are not listed on the Australian Stock Exchange (ASX), making it challenging for Australian investors to gain exposure to this sector. The HACK ETF addresses this gap by providing access to a portfolio of global cybersecurity companies that are otherwise difficult to invest in through the ASX. This makes the HACK ETF an attractive option for investors looking to diversify their portfolios and capitalize on the growth of the cybersecurity industry.

Key Features of HACK ETF

The Betashares Global Cybersecurity ETF (HACK) offers investors a straightforward way to invest in a diversified mix of leading global cybersecurity companies. Here are the key features of the HACK ETF:

- ASX Code: HACK – When searching for this ETF on the Australian Stock Exchange, use the code “HACK.” This makes it easy to find and trade.

- Management Fee: 0.57% per annum – The annual management fee for the HACK ETF is 0.57%. This fee covers the costs of managing the fund, making it a cost-effective option for investors looking to gain exposure to the cybersecurity sector.

- Fund Inception Date: August 30, 2016 – The HACK ETF was launched on August 30, 2016. Since its inception, it has provided investors with a way to invest in the growing cybersecurity industry.

- Distribution Frequency: Semi-annual – The HACK ETF distributes earnings to investors twice a year. This semi-annual distribution can be a reliable source of income for investors.

- Index: Nasdaq Consumer Technology Association Cybersecurity Index – The HACK ETF tracks the Nasdaq Consumer Technology Association Cybersecurity Index. This index includes top companies in the cybersecurity field, ensuring that the ETF provides exposure to leading firms in this sector.

Benefits of the HACK ETF

Investing in the HACK ETF allows you to gain exposure to a fast-growing global sector. Here’s why it’s beneficial:

- Diversified Portfolio: The HACK ETF includes a range of global cybersecurity companies, reducing the risk associated with investing in individual stocks.

- Access to Industry Leaders: The ETF features both established leaders and promising new companies in the cybersecurity field, giving investors a balanced exposure to the industry.

- Growth Potential: As cyber threats continue to increase, the demand for cybersecurity solutions is expected to grow, offering significant growth potential for companies in this sector.

The HACK ETF is an excellent choice for investors looking to invest in the cybersecurity sector without the hassle of picking individual stocks. Its key features, such as a low management fee, semi-annual distributions, and tracking a reputable index, make it a compelling option. Additionally, its diversified portfolio provides exposure to a broad range of companies, from industry giants to innovative newcomers, ensuring you benefit from the overall growth of the cybersecurity sector.

Investing in the HACK ETF is straightforward and provides a cost-effective way to tap into the lucrative cybersecurity market. Whether you are a seasoned investor or new to ETFs, HACK offers a balanced, diversified approach to investing in one of the most critical industries today.

HACK ETF’s Financial Landscape

Understanding the financial landscape of the Betashares Global Cybersecurity ETF (HACK) is crucial for investors. This snapshot provides essential data about the ETF’s market presence and potential for growth. Here are the key financial metrics for HACK:

- Current Price: $11.49 – The current trading price of HACK shares on the Australian Stock Exchange (ASX) is $11.49. This reflects the latest market value at which investors can buy or sell the ETF.

- Net Assets: $922,765,403 – The total net assets of the HACK ETF amount to $922.8 million. This figure represents the total market value of all the assets held within the fund, providing an indication of its size and investment capacity.

- Units Outstanding: 80,442,268 – HACK has 80,442,268 units outstanding. This number indicates how many shares of the ETF are currently held by investors, which helps in understanding its liquidity and market activity.

- NAV per Unit: $11.47 – The Net Asset Value (NAV) per unit of HACK is $11.47. The NAV per unit is calculated by dividing the total net assets of the ETF by the number of outstanding units. It represents the intrinsic value of each unit, offering insight into the underlying value of the ETF compared to its market price.

- Distribution Yield (12m): 0.0% – The distribution yield over the past 12 months is 0.0%. This metric shows the income generated from the ETF’s holdings and distributed to investors as dividends. Although currently at 0.0%, this figure can vary based on the ETF’s performance and income distribution policies.

Table: HACK ETF Financial Metrics

| Metric | Value |

| Current Price | $11.49 |

| Net Assets | $922,765,403 |

| Units Outstanding | 80,442,268 |

| NAV per Unit | $11.47 |

| Distribution Yield | 0.0% |

Key Insights for Investors

- Market Presence: With a current price of $11.49 and net assets nearing $923 million, HACK shows substantial market presence and investor interest.

- Investment Capacity: The high number of units outstanding (over 80 million) indicates robust market activity and liquidity, making it easier for investors to buy or sell shares.

- Valuation: The NAV per unit of $11.47 closely aligns with the current market price, suggesting that the ETF is fairly valued. This alignment helps investors assess the worth of their investments accurately.

- Income Distribution: While the distribution yield is currently 0.0%, it’s important to monitor this metric as it can provide additional income to investors through dividends.

Performance Overview

The performance of the Betashares Global Cybersecurity ETF (HACK) highlights the strong growth potential of the cybersecurity sector. By tracking key metrics, investors can gauge how the fund has performed historically and compare it to its benchmark index. This performance overview provides valuable insights into the fund’s return on investment over different periods.

Performance Metrics

The table below shows the performance of HACK compared to the Nasdaq Consumer Technology Association Cybersecurity Index over various time frames:

| Period | Fund Performance | Index Performance |

| 1 Month | -3.70% | -3.66% |

| 3 Months | -1.49% | -1.39% |

| 6 Months | 18.55% | 18.96% |

| 1 Year | 38.60% | 39.84% |

| 3 Years p.a. | 13.73% | 14.43% |

| 5 Years p.a. | 15.19% | 15.77% |

| Since Inception | 17.21% | 17.89% |

Note: Past performance is not indicative of future performance.

- 1 Month Performance: Over the past month, HACK experienced a slight decline of 3.70%, which is in line with the index’s performance of -3.66%. Short-term fluctuations are common in the stock market, reflecting immediate market conditions.

- 3 Months Performance: In the last three months, HACK declined by 1.49%, closely mirroring the index’s decline of 1.39%. This period shows minor volatility but maintains alignment with the index.

- 6 Months Performance: Over the past six months, HACK demonstrated significant growth with an 18.55% return, just slightly underperforming the index at 18.96%. This substantial growth reflects the increasing demand for cybersecurity solutions.

- 1 Year Performance: The one-year performance shows an impressive return of 38.60% for HACK, closely following the index’s 39.84%. This indicates strong annual growth driven by the cybersecurity sector’s expansion.

- 3 Years Annualized Performance: Over three years, HACK has an annualized return of 13.73%, compared to the index’s 14.43%. This period highlights the fund’s consistent performance and resilience.

- 5 Years Annualized Performance: For the five-year period, HACK achieved a 15.19% annualized return, slightly trailing the index’s 15.77%. This long-term view underscores the fund’s robust growth potential.

- Since Inception: Since its inception, HACK has delivered a return of 17.21% per annum, closely aligning with the index’s 17.89%. This long-term performance showcases the fund’s ability to capture the growth of the cybersecurity industry.

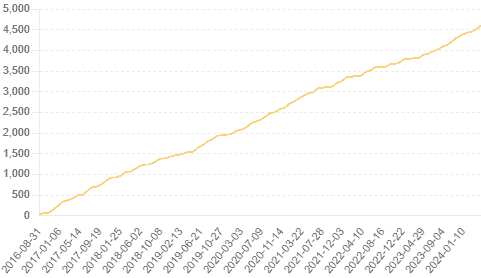

Graph: Value of $100 Invested Since Inception

The graph above illustrates the growth of $100 invested in the HACK ETF since its inception. This visual representation helps investors understand the fund’s performance trajectory over time, showing how their investment could have grown.

Key Takeaways for Investors

- Consistent Growth: The HACK ETF has shown consistent growth across various time frames, reflecting the strong performance of the cybersecurity sector.

- Alignment with Index: The fund’s performance closely aligns with its benchmark index, indicating effective tracking and management.

- Long-term Potential: The impressive returns since inception highlight the long-term growth potential of investing in the cybersecurity sector through HACK.

Top Holdings and Sector Insight

Understanding the composition of the Betashares Global Cybersecurity ETF (HACK) is crucial for assessing its investment potential. The fund’s holdings and sector allocation provide a clear picture of where your money is invested and how diversified the portfolio is within the cybersecurity sector.

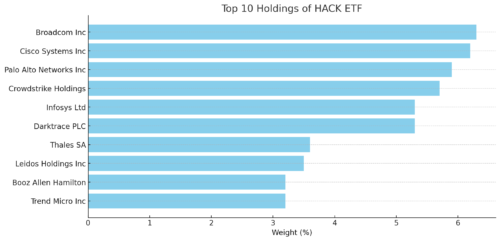

Top 10 Holdings

The HACK ETF includes a selection of top-performing companies in the cybersecurity field. These companies are leaders in developing and implementing cybersecurity solutions, ranging from software to hardware and consulting services. Here are the top 10 holdings of HACK and their respective weights in the fund:

| Company | Weight (%) |

| Broadcom Inc | 6.3% |

| Cisco Systems Inc | 6.2% |

| Palo Alto Networks Inc | 5.9% |

| Crowdstrike Holdings | 5.7% |

| Infosys Ltd | 5.3% |

| Darktrace PLC | 5.3% |

| Thales SA | 3.6% |

| Leidos Holdings Inc | 3.5% |

| Booz Allen Hamilton | 3.2% |

| Trend Micro Inc | 3.2% |

These companies are at the forefront of the cybersecurity industry, providing a mix of established players and innovative firms. This blend helps in achieving both stability and growth within the fund.

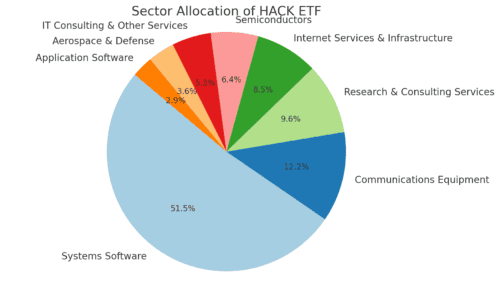

Sector Allocation

The sector allocation of HACK ETF reveals a strategic distribution of investments across various segments within the cybersecurity industry. This diversification helps to mitigate risks associated with over-concentration in a single area. Below is the sector allocation of the HACK ETF:

| Sector | Allocation (%) |

| Systems Software | 51.6% |

| Communications Equipment | 12.2% |

| Research & Consulting Services | 9.6% |

| Internet Services & Infrastructure | 8.5% |

| Semiconductors | 6.4% |

| IT Consulting & Other Services | 5.3% |

| Aerospace & Defense | 3.6% |

| Application Software | 2.9% |

The sector allocation table shows a strong emphasis on systems software, which comprises over half of the fund’s investments. This is followed by communications equipment and research & consulting services, highlighting the fund’s focus on comprehensive cybersecurity solutions.

Key Insights for Investors

- Diverse Portfolio: The HACK ETF includes a variety of companies across different sub-sectors of the cybersecurity industry, offering a well-rounded investment.

- Focus on Systems Software: With 51.6% of the fund allocated to systems software, HACK invests heavily in companies that develop critical software solutions to protect against cyber threats.

- Established and Emerging Companies: The top holdings feature a mix of established industry leaders like Broadcom Inc and Cisco Systems Inc, as well as emerging companies like Darktrace PLC, providing a balance of stability and growth potential.

- Global Exposure: The fund’s investments are not limited to a single country, offering exposure to global cybersecurity trends and innovations.

Investing in the HACK ETF allows you to gain exposure to the cybersecurity sector, which is crucial in today’s digital age. The fund’s diversified holdings and strategic sector allocation provide a balanced approach to investing in this high-growth industry. By understanding the top holdings and sector insights, you can make an informed decision about including HACK in your investment portfolio.

The Betashares Global Cybersecurity ETF offers a smart and efficient way to invest in a critical sector poised for long-term growth. Whether you are a seasoned investor or new to ETFs, HACK provides an opportunity to benefit from the rising demand for cybersecurity solutions across the globe.

Global Allocation

The HACK ETF provides global exposure with significant investments in various countries. This diversification helps mitigate country-specific risks.

| Country | Allocation (%) |

| United States | 73.1% |

| Canada | 5.4% |

| India | 5.3% |

| Britain | 5.3% |

| Israel | 4.0% |

| Other | 7.0% |

The country allocation shows a strong focus on the United States, reflecting the dominance of US companies in the cybersecurity sector.

Benefits of Investing in HACK ETF

Investing in the Betashares Global Cybersecurity ETF (HACK) offers numerous advantages for investors looking to capitalize on the growing cybersecurity sector. Here are some key benefits:

Exposure to a Growing Sector

The HACK ETF provides exposure to the rapidly expanding cybersecurity industry. As cybercrime continues to rise, businesses and governments are investing heavily in cybersecurity measures to protect sensitive data and infrastructure. This growing demand for cybersecurity services is expected to drive significant growth in the sector, offering robust potential returns for investors. By investing in HACK, you can benefit from the growth of companies at the forefront of this critical industry.

Diversification

One of the main benefits of the HACK ETF is diversification. Instead of putting all your money into a single cybersecurity company, the HACK ETF spreads your investment across multiple companies within the sector. This diversification helps reduce the risk associated with investing in individual stocks. It provides a balanced exposure to various segments of the cybersecurity industry, including software development, hardware manufacturing, and consulting services.

Access to Industry Leaders

The HACK ETF includes a mix of established industry leaders and innovative emerging companies. This provides a balanced investment approach, allowing you to benefit from the stability and proven performance of well-known companies like Broadcom Inc and Cisco Systems Inc, while also gaining exposure to high-growth potential companies like Crowdstrike Holdings and Darktrace PLC. This combination of established giants and emerging players offers a unique opportunity to invest in the full spectrum of the cybersecurity market.

Key Advantages of HACK ETF

- Growth Potential: Cybersecurity is a high-growth sector with increasing relevance in today’s digital age. The HACK ETF allows you to tap into this growth potential by investing in companies that are leading the charge against cyber threats.

- Risk Mitigation: Diversification within the HACK ETF helps mitigate the risks that come with investing in individual stocks. By spreading your investment across multiple companies, you reduce the impact of any single company’s poor performance on your overall portfolio.

- Global Reach: The HACK ETF invests in cybersecurity companies from around the world. This global exposure ensures that you are not limited to the performance of companies in one region but can benefit from the growth of cybersecurity solutions on a global scale.

- Convenient and Cost-Effective: Investing in the HACK ETF provides a convenient way to gain exposure to the cybersecurity sector without the need to research and invest in individual stocks. The management fee of 0.57% per annum is relatively low, making it a cost-effective investment option.

Why Choose HACK ETF?

Choosing the HACK ETF means investing in a sector that is vital to the modern economy and poised for substantial growth. Cybersecurity is becoming increasingly important as cyber threats evolve and become more sophisticated. By investing in the HACK ETF, you can:

- Benefit from Industry Growth: As the demand for cybersecurity services increases, the companies within the HACK ETF are well-positioned to grow and generate strong returns.

- Achieve Diversification: The HACK ETF provides exposure to a diversified portfolio of global cybersecurity companies, reducing the risk of your investment.

- Access Leading Companies: The fund includes a mix of established leaders and emerging innovators in the cybersecurity sector, ensuring a balanced investment approach.

Investing in the HACK ETF is a strategic way to participate in the growth of the cybersecurity industry. Whether you are looking for long-term growth or a balanced addition to your investment portfolio, the HACK ETF offers a compelling opportunity to invest in a critical and rapidly growing sector.

How to Buy HACK ASX Shares

Investing in HACK is straightforward and can be done through various platforms:

- Choose a Platform: Use any brokerage platform that allows trading on the ASX.

- Place an Order: Search for HACK using its ASX code and place a buy order.

- Minimum Investment: There is no minimum investment requirement, making it accessible for all types of investors.

- Distribution Reinvestment: Investors can choose to reinvest distributions through a Distribution Reinvestment Plan (DRP) or receive cash.

Platforms and Strategies

- Brokerage Platforms: Popular platforms like CommSec, ANZ Share Investing, and others offer trading on the ASX.

- Investment Strategies: Consider a long-term investment strategy to benefit from the growth in the cybersecurity sector or use HACK as part of a diversified portfolio.

Future Outlook for HACK ETF

The future outlook for the Betashares Global Cybersecurity ETF (HACK) is exceptionally promising, driven by the ever-growing importance of cybersecurity in our digital world. Here’s why the HACK ETF is poised for continued growth and why it’s a smart investment choice for the future.

Continuous Growth in the Cybersecurity Sector

The cybersecurity sector is expected to maintain its upward growth trajectory due to the increasing frequency and sophistication of cyber threats. As businesses and individuals rely more on digital platforms, the need for robust cybersecurity measures becomes critical. This rising demand is a significant growth driver for companies in the HACK ETF.

Advancements in Technology

Technological advancements are at the heart of the cybersecurity industry’s growth. Innovations in artificial intelligence, machine learning, and blockchain technology are enhancing the capabilities of cybersecurity solutions. Companies within the HACK ETF are leveraging these advancements to develop cutting-edge security measures that can effectively combat new and evolving cyber threats.

Increased Regulatory Requirements

Governments and regulatory bodies worldwide are implementing stricter regulations to protect sensitive data and ensure cybersecurity compliance. This regulatory push is compelling organizations to invest more in cybersecurity infrastructure and services. Companies in the HACK ETF are well-positioned to benefit from this increased spending as they provide the necessary solutions to meet these regulatory demands.

Ongoing Battle Against Cybercrime

The battle against cybercrime is an ongoing challenge that necessitates constant innovation and investment in cybersecurity. Cybercriminals are becoming more sophisticated, employing advanced techniques to breach security defences. This perpetual threat ensures a continuous need for improved cybersecurity measures, driving the demand for the products and services offered by companies in the HACK ETF.

Market Trends Supporting Growth

Several market trends support the positive future outlook for the HACK ETF:

- Cloud Security: With the increasing adoption of cloud computing, cloud security has become a critical area of focus. Companies in the HACK ETF are leaders in providing cloud security solutions, positioning them to capitalize on this growing market.

- Internet of Things (IoT) Security: The proliferation of IoT devices has opened new avenues for cyber threats. Companies within the HACK ETF are developing specialized security solutions to protect these devices, ensuring they stay ahead in this emerging market.

- Data Privacy: Data breaches and privacy concerns are driving organizations to prioritize data security. The HACK ETF includes companies that specialize in data encryption, protection, and privacy solutions, making them crucial players in this vital area.

Key Drivers for Future Growth

- Technological Innovation: Continuous advancements in cybersecurity technologies will drive the growth of companies in the HACK ETF.

- Regulatory Compliance: Increasing regulatory requirements globally will boost demand for comprehensive cybersecurity solutions.

- Evolving Cyber Threats: The persistent threat of cybercrime ensures ongoing investment in cybersecurity, benefiting companies in the ETF.

- Market Expansion: Growth in areas like cloud security, IoT security, and data privacy will create new opportunities for companies within the HACK ETF.

Tax Considerations for Investing in HACK ETF

Investing in the Betashares Global Cybersecurity ETF (HACK) comes with tax implications that every investor should understand. Proper tax planning can help you maximize your returns and ensure compliance with tax regulations. Here are some key tax considerations to keep in mind when investing in HACK ETF.

Capital Gains Tax

When you sell your HACK ETF units for a profit, the gains are subject to capital gains tax (CGT). The amount of CGT you pay depends on how long you held the units:

- Short-term Capital Gains: If you held the units for less than 12 months, the gains are taxed at your marginal tax rate.

- Long-term Capital Gains: If you held the units for 12 months or more, you might be eligible for a CGT discount, reducing the taxable amount by 50% for individual investors.

It’s important to keep track of your holding periods to benefit from potential tax discounts on long-term investments.

Distribution Treatment

The HACK ETF distributes earnings to investors, typically in the form of dividends. These distributions can include income such as:

- Dividends: Payments made from the profits of the companies within the ETF.

- Interest Income: Earnings from interest-bearing securities.

- Capital Gains Distributions: Profits from the sale of securities within the ETF.

Each type of distribution has different tax treatments. Dividends may come with franking credits, which can offset the tax payable on your income. Interest income is usually taxed at your marginal tax rate. Capital gains distributions are treated as capital gains and are subject to CGT rules.

Foreign Income Tax

Since the HACK ETF includes global companies, part of your investment income may come from foreign sources. This income might be subject to withholding tax by the country where the income originates. However, Australia has tax treaties with many countries, which may reduce the amount of withholding tax. You can often claim a foreign income tax offset to reduce your Australian tax liability.

Tax Statements

Betashares provides annual tax statements to investors, detailing the types of income received and the applicable tax treatments. These statements are essential for accurate tax reporting and can help you or your tax professional prepare your tax return.

Importance of Consulting a Tax Professional

Tax laws and regulations can be complex, and they frequently change. Consulting a tax professional ensures that you:

- Understand Your Tax Obligations: A tax professional can explain the specific tax implications of your HACK ETF investments.

- Maximize Tax Benefits: They can help you take advantage of tax discounts and offsets, such as the CGT discount for long-term holdings and foreign income tax offsets.

- Ensure Compliance: Proper guidance helps you comply with all relevant tax laws and avoid penalties.

Key Takeaways

- Capital Gains Tax: Be aware of the tax on profits from selling ETF units and the benefits of holding investments long-term.

- Distribution Taxes: Understand the different types of income from ETF distributions and their tax implications.

- Foreign Income: Know how foreign income is taxed and how to claim offsets.

- Professional Advice: Always consult a tax professional to navigate the complexities of tax regulations and maximise your investment returns.

Investing in the HACK ETF can offer significant growth potential, but it’s crucial to consider the tax implications. Proper tax planning and professional advice can help you make the most of your investment while ensuring compliance with tax laws.

Conclusion

The future outlook for the Betashares Global Cybersecurity ETF (HACK) is highly optimistic. The ETF provides exposure to a sector that is not only growing but is also essential to the security and functionality of modern digital economies. By investing in the HACK ETF, you position yourself to benefit from the technological advancements, regulatory developments, and continuous demand for cybersecurity solutions.

Investing in the HACK ETF means investing in the future of cybersecurity. As cyber threats evolve and become more sophisticated, the need for advanced security solutions will only increase, driving the growth of the companies within this ETF. With its strategic focus on leading cybersecurity firms, the HACK ETF is well-positioned to deliver strong returns and robust growth in the years to come.

About Betashares Betashares Capital Ltd is a leading provider of ETFs in Australia, managing a range of funds that offer exposure to various sectors and indices. Founded in 2009, Betashares has grown to manage over $20 billion in assets.

FAQ for Betashares Global Cybersecurity ETF (HACK)

Is HACK ETF a good buy?

The HACK ETF is a strong buy for investors looking to gain exposure to the rapidly growing cybersecurity sector. With a diversified portfolio of leading global cybersecurity companies, strong historical performance, and the increasing importance of cybersecurity, HACK offers significant growth potential. However, it’s important to conduct your own research and consider your financial goals and risk tolerance before investing.

What is the HACK dividend for 2024?

As of now, the exact dividend for HACK in 2024 has not been announced. Investors should check the official Betashares website or their brokerage accounts for the most up-to-date information on dividend declarations and distributions.

Does HACK ETF pay a dividend?

Yes, the HACK ETF pays dividends. The fund distributes earnings to investors, typically on a semi-annual basis. These distributions may include dividends from the underlying stocks, interest income, and capital gains.

What is the forecast for HACK ETF?

The forecast for HACK ETF is positive, driven by the growing demand for cybersecurity solutions amid rising cyber threats. Technological advancements, increased regulatory requirements, and continuous investment in cybersecurity infrastructure are expected to support the ETF’s growth. However, market conditions can change, and it’s important to stay informed about industry trends and economic factors that may impact the fund.

What is the biggest risk in ETF?

The biggest risk in investing in any ETF, including HACK, is market risk. Market risk involves the possibility of losing value due to overall market declines. For HACK specifically, other significant risks include sector-specific risks, such as technological changes, competitive pressures, and regulatory challenges within the cybersecurity industry.

Who runs HACK ETF?

The HACK ETF is managed by Betashares Capital Ltd, a leading provider of exchange-traded funds in Australia. Betashares is known for its wide range of ETFs that offer exposure to various sectors and indices.

What is the best cybersecurity ETF?

While HACK is a top contender due to its diversified holdings and strong performance, the best cybersecurity ETF for you depends on your investment goals and strategy. Other notable cybersecurity ETFs include the First Trust NASDAQ Cybersecurity ETF (CIBR) and the Global X Cybersecurity ETF (BUG). Comparing these ETFs based on factors like performance, fees, and holdings can help you determine the best fit for your portfolio.

What is the yield of HACK stock?

The yield of HACK ETF can vary based on market conditions and the performance of its underlying assets. As of the latest data, the distribution yield for HACK is 0.0% over the past 12 months. Investors should check the most recent yield information on the Betashares website or through their brokerage accounts.

What are the fees associated with HACK ETF?

The management fee for HACK ETF is 0.57% per annum. This fee covers the cost of managing the fund and is relatively low compared to other investment options.

What types of companies are included in HACK ETF?

HACK ETF includes a mix of established industry leaders and emerging companies in the cybersecurity sector. The top holdings feature companies involved in systems software, communications equipment, and consulting services, among others.

How does HACK ETF achieve diversification?

HACK ETF achieves diversification by investing in a wide range of companies within the cybersecurity sector. This includes firms specializing in different aspects of cybersecurity, such as software development, hardware manufacturing, and consulting services, which helps spread risk across multiple segments.

Expand Your Financial Knowledge: Visit our Personal Finance section for essential tips, delve into Property Investing for the latest market insights, or explore our comprehensive Resources for educational articles and tools. If you’re interested in the stock market, our Shares & ETFs section offers a range of options to suit your investment goals. Dive into these areas to enhance your financial understanding and decision-making.

Disclaimer

Estimations for Illustrative Purposes: The GST calculations generated by this Australian GST Calculator are approximations intended for educational and illustrative purposes only. While we strive for accuracy, actual GST liabilities may differ due to specific circumstances or changes in tax laws.

Excludes Other Considerations: This Australian GST Calculator focuses solely on Goods and Services Tax (GST) estimations. It does not incorporate other potential fiscal obligations, such as additional taxes, levies, or deductions that may impact the total amount payable when managing your finances or business operations.

Not Professional Financial Advice: The use of this GST calculator does not constitute financial advice. It is not intended to replace professional consultation and should not be the only factor in making financial decisions. For personalized financial guidance, we recommend seeking advice from a qualified tax consultant or financial advisor.

Use at Your Discretion: By using this Australian GST Calculator, you understand and agree that the outcomes are estimates and that your specific tax situation may vary. Any actions taken based on the calculator’s results are done at your own discretion and risk.

Not a Licensed Financial Advisor

The information and insights provided in this document are intended solely for educational and informational purposes. It’s imperative to understand that I am not a licensed financial advisor, tax expert, or investment strategist. The contents herein are crafted to offer a general overview and should not be construed as personalized financial advice.

Affiliate Disclosure: Some of the links on this blog may be affiliate links. This means if you click on the link and purchase a product or service, I may receive a commission at no additional cost to you. I only recommend products or services that I believe in, and that may be helpful to my readers.

Before making any financial decisions or embarking on investment ventures, it’s crucial to consult with a professional financial advisor or a certified tax consultant who is well-equipped to understand your unique financial landscape. Engaging with a licensed professional ensures that the advice you receive is tailored to your specific financial goals, risk tolerance, and tax obligations, adhering to the compliance and guidelines established by regulatory authorities, including the Australian Taxation Office (ATO) and other relevant bodies.

Financial markets are complex and dynamic and involve various degrees of risk. Therefore, thorough due diligence and professional guidance are essential to navigate these waters effectively. This content does not represent the opinions or endorsements of any financial institutions or regulatory agencies. Remember, the responsibility for financial decisions lies with the individual, and seeking qualified advice is the best step towards informed decision-making and achieving financial objectives.