Exploring the distinct investment strategies and performance metrics of A200 vs VHY to guide your portfolio decisions.

Investing in the Australian share market can be a great way to build wealth over the long term. However, sifting through the hundreds of individual stocks listed on the ASX can be a daunting task, especially for new or busy investors. This is where Australian shares exchange-traded funds (ETFs) come into play.

ETFs provide a simple and cost-effective way to gain diversified exposure to the Australian equity market. Two of the most popular Australian shares ETFs are the BetaShares Australia 200 ETF (ASX: A200) and the Vanguard Australian Shares High Yield ETF (ASX: VHY). In this in-depth article, we’ll dive deep into the details of these two ETFs, compare their key features, and help you determine which one might be the better fit for your investment portfolio.

Why Invest in Australian Shares ETFs?

Before we delve into the specifics of the A200 and VHY ETFs, let’s briefly discuss the benefits of investing in Australian shares ETFs in general:

- Diversification: ETFs allow you to gain exposure to a basket of Australian stocks, providing instant diversification and reducing the risk associated with investing in individual companies.

- Cost-Effectiveness: Australian shares ETFs typically have lower management fees compared to actively managed funds, making them a more cost-efficient way to invest in the Australian equity market.

- Simplicity: ETFs offer a straightforward and hassle-free way to invest, as they track a specific index or investment strategy, eliminating the need for extensive stock-picking research.

- Liquidity: Most Australian shares ETFs are highly liquid, meaning you can buy and sell units easily on the ASX, providing flexibility in managing your investments.

BetaShares Australia 200 ETF (A200): An Overview

The BetaShares A200 ETF is designed to track the performance of the S&P/ASX 200 Index, which represents the 200 largest companies listed on the Australian Securities Exchange (ASX) by market capitalization. By investing in the A200 ETF, you gain exposure to a diverse range of sectors, including financials, materials, healthcare, and more.

One of the standout features of the A200 ETF is its ultra-low management fee of just 0.04% per annum, making it one of the cheapest Australian shares ETFs on the market. This cost-effectiveness, combined with its broad market exposure, makes the A200 a popular choice for investors seeking a simple and efficient way to invest in the Australian equity market.

Vanguard Australian Shares High Yield ETF (VHY): An Overview

The Vanguard VHY ETF, on the other hand, takes a slightly different approach. Instead of tracking the broader Australian market, VHY focuses on companies that are expected to pay higher-than-average dividends relative to their peers. The fund aims to provide investors with a steady stream of income by investing in these high-yielding Australian stocks.

VHY tracks the FTSE Australia High Dividend Yield Index, which selects the highest-yielding Australian companies until it reaches approximately 50% of the market capitalization of the broader Australian equity universe. The fund’s portfolio is also diversified across sectors, with financials, materials, and energy being the largest allocations.

While VHY’s management fee of 0.25% per annum is slightly higher than the A200’s, it is still considered a low-cost option in the context of the Australian ETF landscape.

A200 vs VHY: Comparing the Two ETFs

To help you understand the key differences between the A200 and VHY ETFs, let’s compare their key features in a side-by-side table:

| Feature | BetaShares A200 ETF | Vanguard VHY ETF |

|---|---|---|

| Investment Objective | Track the S&P/ASX 200 Index | Track the FTSE Australia High Dividend Yield Index |

| Index Tracked | S&P/ASX 200 Index | FTSE Australia High Dividend Yield Index |

| Management Fee | 0.04% p.a. | 0.25% p.a. |

| 5-Year Performance (p.a.) | 9.16% | 9.36% |

| Top 10 Holdings (% of ETF) | 48.88% | 58.92% |

| Sector Allocation | Financials (28.3%), Materials (22.2%), Healthcare (11.5%) | Financials (42.4%), Materials (20.4%), Energy (10.7%) |

ETF Management Fees

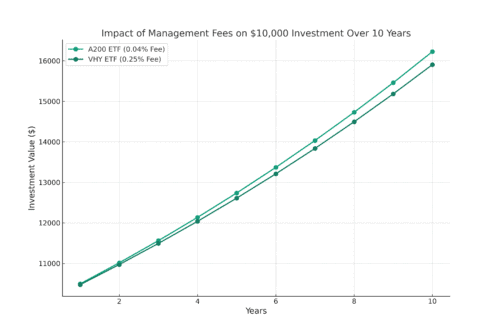

One of the most significant differences between the A200 and VHY ETFs is their management fees. The A200 ETF has an incredibly low management fee of just 0.04% per annum, while the VHY ETF has a slightly higher fee of 0.25% per annum.

This difference in fees can have a substantial impact on the long-term performance of your investment. The lower the fees, the more of your investment returns you get to keep.

Assumptions

Here’s a visual representation of the impact of fees on a hypothetical investment of $10,000 over ten years:

- Initial Investment: Both investments start with a principal amount of $10,000.

- Annual Growth Rate: Each investment is assumed to grow at a constant annual rate of 5% before fees.

- Management Fees:

- A200 ETF: Charges a management fee of 0.04% per annum.

- VHY ETF: Charges a management fee of 0.25% per annum.

- Fee Deduction: Management fees are deducted annually from the total return, reducing the effective growth rate:

- A200 ETF: Effective annual growth rate after fees is approximately 4.96%.

- VHY ETF: Effective annual growth rate after fees is approximately 4.75%.

- Compounding: Returns are compounded annually, meaning each year’s growth builds on the previous year’s total.

- Investment Duration: The comparison covers a period of 10 years to illustrate the long-term impact of fees.

As you can see, the lower management fee of the A200 ETF can result in significantly higher returns over the long run, all else being equal.

Dividends and Income: A200 vs VHY

Both the A200 and VHY ETFs provide investors with exposure to dividend-paying Australian companies. However, the two funds differ in their focus and approach to dividends.

The A200 ETF aims to track the broader Australian market, so its dividend yield and income stream will reflect the overall dividend payments of the large-cap companies in the S&P/ASX 200 Index. As of January 2024, the A200 ETF had a 12-month dividend yield of 4.8%.

In contrast, the VHY ETF specifically targets high-yielding Australian stocks, with the goal of providing investors with a steady stream of dividend income. As of January 2024, VHY had a 12-month dividend yield of 5.20%, which is higher than the A200’s yield.

It’s worth noting that both ETFs offer the potential for franking credits, which can provide additional tax benefits for Australian investors.

Performance Comparison: A200 vs VHY

Over the long term, both the A200 and VHY ETFs have delivered strong performance, outpacing the broader Australian equity market as measured by the S&P/ASX 300 Index.

Looking at the 5-year annualized total returns up to February 2024:

- A200 ETF: 9.40% p.a.

- VHY ETF: 10.50% p.a.

The VHY ETF has a slight edge in terms of longer-term performance thanks to its focus on high-yielding stocks. However, past performance is not indicative of future results, and both ETFs have exhibited similar levels of volatility and risk during this period.

To provide a more comprehensive view of the performance comparison, let’s look at the annual total returns of the A200 and VHY ETFs over the past five years:

Annual Performance Comparison:

Source: Yahoo Finance

| Year | A200 ETF | VHY ETF |

|---|---|---|

| 2023 | 12.01% | 11.5% |

| 2022 | -0.55% | 8.52% |

| 2021 | 17.92% | 16.78% |

| 2020 | 1.13% | 1.67% |

| 2019 | 22.86% | 20.45% |

As you can see, both the A200 and VHY ETFs have outperformed the broader Australian equity market, with VHY slightly edging out A200 in most years.

Top Holdings Comparison:

In addition to the performance comparison, let’s take a closer look at the top holdings of the A200 and VHY ETFs:

| Top 10 Holdings | A200 ETF | VHY ETF |

|---|---|---|

| Commonwealth Bank | 9.65% | 9.65% |

| BHP Group | 8.73% | 8.73% |

| National Australia Bank | 7.75% | 7.75% |

| Wesfarmers | 7.33% | 7.33% |

| Westpac Banking | 6.71% | 6.71% |

| ANZ Group | 4.66% | 4.66% |

| Macquarie Group | 3.29% | 3.29% |

| CSL | 5.91% | – |

| Woodside Energy | 2.52% | 2.52% |

| Goodman Group | 2.33% | 2.28% |

| Total Top 10 Holdings | 48.88% | 58.92% |

As you can see, the top 10 holdings make up a larger percentage of the VHY ETF’s portfolio compared to the A200 ETF. This indicates that VHY has a more concentrated portfolio, which could potentially increase its risk profile.

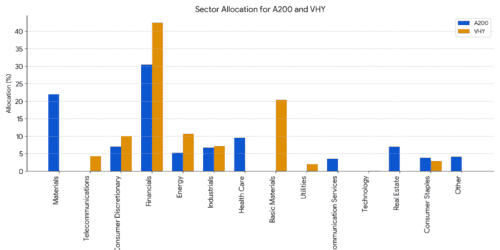

Sector Allocation

| Sector | A200 (%) | VHY (%) |

|---|---|---|

| Financials | 30.5 | 42.5 |

| Materials | 22 | 0 |

| Health Care | 9.6 | 0 |

| Consumer Discretionary | 7.1 | 10 |

| Real Estate | 7 | 0 |

| Industrials | 6.8 | 7.2 |

| Energy | 5.3 | 10.7 |

| Other | 4.2 | 0 |

| Consumer Staples | 3.9 | 2.9 |

| Communication Services | 3.6 | 0 |

| Basic Materials | 0 | 20.4 |

| Technology | 0 | 0.1 |

| Telecommunications | 0 | 4.3 |

| Utilities | 0 | 2 |

Risks and Considerations

While both the A200 and VHY ETFs offer attractive features, it’s important to consider the potential risks associated with each:

A200 Risks:

- Broad market exposure means it may underperform during periods of sector-specific or stock-specific downturns.

- Potential volatility due to its exposure to the overall Australian equity market.

VHY Risks:

- Concentration risk is due to the higher weighting in the financials and materials sectors.

- Potential for higher volatility due to the focus on high-yielding stocks.

- Dividend yields can fluctuate, impacting the income stream.

Ultimately, the choice between the A200 and VHY ETFs will depend on your individual investment goals, risk tolerance, and preferences regarding dividends and income. By carefully considering the information presented in this article, you can make an informed decision that aligns with your overall investment strategy.

Conclusion

The BetaShares A200 ETF and the Vanguard VHY ETF are two of the most prominent Australian shares ETFs, offering investors different approaches to gaining exposure to the Australian equity market. The A200 ETF provides broad market coverage at an extremely low cost, while the VHY ETF targets high-yielding stocks to generate a steady stream of dividend income.

Depending on your investment objectives, risk tolerance, and preferences around dividends, either the A200 or VHY ETF could be a suitable addition to your portfolio. By understanding the key features and differences between these two ETFs, as well as the potential impact of management fees, dividend yields, and sector allocations, you can make an informed decision that aligns with your overall investment strategy.

Ultimately, both the A200 and VHY ETFs are strong contenders in the Australian shares ETF landscape, and the choice between them will depend on your specific investment goals and preferences. By carefully considering the factors discussed in this article, you can determine which ETF best fits your investment needs and helps you achieve your long-term financial objectives.

FAQs for VHY vs A200

What is the difference between A200 and VHY?

A200 (BetaShares Australia 200) tracks the top 200 largest companies listed on the Australian Securities Exchange (ASX) based on market capitalization.

VHY (Vanguard Australian Shares High Yield) focuses on companies within the ASX that offer higher forecast dividend yields

Which ETF has a higher dividend yield, A200 or VHY?

Typically, VHY offers a higher dividend yield due to its focus on high-dividend-paying companies.

Which ETF has a better growth potential, A200 or VHY?

A200 might have better growth potential as it includes a wider range of companies, some of which might be in high-growth sectors. VHY focuses on established companies that may offer more stable dividends but potentially lower growth.

Which ETF is more diversified, A200 or VHY?

A200 is more diversified as it holds 200 companies across various sectors. VHY holds a smaller number of companies but may still offer good diversification depending on the specific holdings.

Which ETF is more volatile, A200 or VHY?

A200 might be slightly more volatile due to its inclusion of companies from various sectors, some of which could be more susceptible to market fluctuations. However, volatility can also depend on current market conditions.

What are the fees associated with each ETF?

Both A200 and VHY have relatively low management fees. It’s important to compare the specific fees associated with each ETF on a brokerage platform before investing.

Which ETF is right for me?

The best ETF for you depends on your investment goals and risk tolerance.

If you prioritize income and are comfortable with potentially lower growth, VHY might be a good choice.

If you prioritize growth potential and are comfortable with slightly higher volatility, A200 could be suitable.

Expand Your Financial Knowledge: Visit our Personal Finance section for essential tips, delve into Property Investing for the latest market insights, or explore our comprehensive Resources for educational articles and tools. If you’re interested in the stock market, our Shares & ETFs section offers a range of options to suit your investment goals. Dive into these areas to enhance your financial understanding and decision-making.

Disclaimer

Not a Licensed Financial Advisor

The information and insights provided in this document are intended solely for educational and informational purposes. It’s imperative to understand that I am not a licensed financial advisor, tax expert, or investment strategist. The contents herein are crafted to offer a general overview and should not be construed as personalized financial advice.

Affiliate Disclosure: Some of the links on this blog may be affiliate links. This means if you click on the link and purchase a product or service, I may receive a commission at no additional cost to you. I only recommend products or services that I believe in, and that may be helpful to my readers.

Before making any financial decisions or embarking on investment ventures, it’s crucial to consult with a professional financial advisor or a certified tax consultant who is well-equipped to understand your unique financial landscape. Engaging with a licensed professional ensures that the advice you receive is tailored to your specific financial goals, risk tolerance, and tax obligations, adhering to the compliance and guidelines established by regulatory authorities, including the Australian Taxation Office (ATO) and other relevant bodies.

Financial markets are complex and dynamic and involve various degrees of risk. Therefore, thorough due diligence and professional guidance are essential to navigate these waters effectively. This content does not represent the opinions or endorsements of any financial institutions or regulatory agencies. Remember, the responsibility for financial decisions lies with the individual, and seeking qualified advice is the best step towards informed decision-making and achieving financial objectives.