Do you want to invest in the top Australian companies without the hassle of picking individual stocks? The BetaShares A200 ETF (ASX: A200) could be the perfect solution. In this article, we’ll dive deep into this popular exchange-traded fund A200 , exploring its features, performance, and whether it deserves a spot in your investment portfolio.

What is an ETF, and Why Consider the A200?

An ETF, or exchange-traded fund, is a type of investment fund that trades on a stock exchange, just like individual stocks. ETFs are designed to track the performance of a specific index, sector, or asset class. The A200 ETF, in particular, aims to provide exposure to the largest 200 companies listed on the Australian Securities Exchange (ASX).

By investing in the A200 ETF, you instantly gain a diversified portfolio of Australia’s top companies, spanning various sectors like banking, mining, healthcare, and more. This diversification can help mitigate risk and potentially smooth out returns over the long term.

Benefits of A200

- Ultra-low-cost – Management costs of 0.04% p.a.*, the lowest cost Australian shares ETF available on the ASX.**

- Portfolio diversification -In a single trade, get diversified exposure to the top 200 companies listed on the ASX.

- Flexible exposure – Use A200 as your core allocation to Australian shares, or to gain tactical exposure to Australian equities.

How Does the A200 ETF Track the ASX 200 Index?

The A200 ETF is designed to replicate the performance of the S&P/ASX 200 Index, which represents the 200 largest companies by market capitalization on the Australian stock market. The fund achieves this by holding shares in each of the companies that make up the index, in the same proportion as their respective weightings.

To ensure accurate tracking, the fund’s portfolio is regularly rebalanced to reflect any changes in the index’s composition, such as companies being added or removed, or their weightings shifting due to market movements.

A200 ETF’s Investment Strategy and Portfolio Composition

The A200 ETF follows a passive investment strategy, meaning it does not actively manage or try to outperform the underlying index. Instead, it aims to replicate the index’s performance as closely as possible, providing investors with a cost-effective way to gain broad exposure to the Australian equity market.

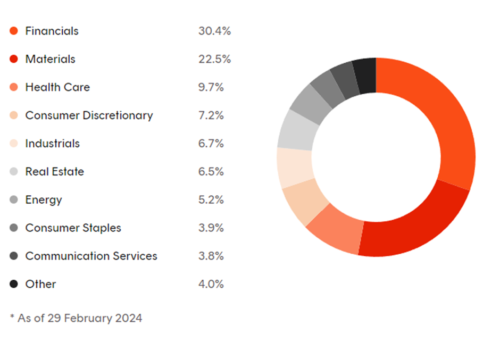

The top holdings in the A200 ETF include familiar names like Commonwealth Bank, BHP Group, CSL Limited, and Westpac Banking Corporation. The fund’s portfolio is well-diversified across various sectors, with financials, materials, and healthcare being the largest allocations.

| Name | Weight (%) |

|---|---|

| BHP GROUP LTD | 9.80% |

| COMMONWEALTH BANK OF AUSTRALIA | 8.50% |

| CSL LTD | 5.90% |

| NATIONAL AUSTRALIA BANK LTD | 4.60% |

| WESTPAC BANKING CORP | 4.00% |

| ANZ GROUP HOLDINGS LTD | 3.80% |

| WESFARMERS LTD | 3.30% |

| MACQUARIE GROUP LTD | 3.30% |

| WOODSIDE ENERGY GROUP LTD | 2.50% |

| GOODMAN GROUP | 2.40% |

**As of 21st Mar 24

Sector Allocation

Fees and Expenses

One of the key advantages of ETFs like the A200 is their low cost structure. The A200 ETF charges a management fee of 0.04% per annum, which is significantly lower than the fees typically charged by actively managed mutual funds.

It’s important to note that investors may also incur additional costs, such as brokerage fees when buying or selling units on the ASX, and the bid-ask spread, which is the difference between the buying and selling prices of the units.

Performance

- Overall Trend: The overall trend is upward, indicating that the investment has grown in value over the five-year period.

- Volatility: There are fluctuations in the price, which is typical for stock market investments. These reflect periods of volatility where the value of the investment has both increased and decreased.

- 2020 Market Impact: A notable dip occurs in early 2020, which coincides with the global financial downturn due to the COVID-19 pandemic. This suggests that the A200 ETF, like many other investments, was affected by the economic uncertainty of the time.

- Recovery Phase: After the initial drop in 2020, there’s a sharp recovery, reflecting a strong rebound which could be due to the overall market recovery, stimulus measures, or investor confidence in the Australian economy or the sectors the A200 ETF is invested in.

- Steady Growth: Post-2020, the price movement shows a steady and consistent upward trend, with some minor peaks and troughs along the way. This indicates a period of relative market stability and continued growth.

- Recent Performance: In the most recent period, leading up to March 2024, the price seems to be plateauing somewhat, with smaller peaks and troughs. This could indicate that the market is consolidating or that investors are cautious due to various market conditions.

- Price Ranges: The investment’s price started at approximately $80, saw a low near $60 during the 2020 downturn, and has reached highs around $120, doubling from its lowest point.

** Past performance is not indicative of future performance. Please refer to “Fund returns after fees” for additional information regarding performance/return information.

Tax Implications and Dividend Distributions

Like any investment, it’s crucial to understand the tax implications of holding the A200 ETF. The fund’s distributions, which include dividends and realized capital gains, may be subject to tax, depending on your individual circumstances and the type of account you hold the units in (e.g., taxable brokerage account, tax-advantaged retirement account).

Annual Distribution Return

The Annual Distribution Return percentages offer a view into the yield investors might expect from their holdings in the A200 ETF. Starting from the most recent distributions, there’s a slight decrease in the annual distribution return, moving from 6.65% in April 2023 down to 4.38% by January 2024. This trend might reflect changes in dividend policies within the constituent companies or broader economic factors affecting company earnings and, consequently, the dividends they can distribute.

| Ex Date | Record Date | Payment Date | Distribution Unit ($) | Annual Distribution Return (%) (1) |

|---|---|---|---|---|

| 2-Jan-24 | 3-Jan-24 | 17-Jan-24 | $1.05 | 4.38% |

| 2-Oct-23 | 3-Oct-23 | 17-Oct-23 | $1.71 | 4.45% |

| 3-Jul-23 | 4-Jul-23 | 18-Jul-23 | $0.80 | 4.87% |

| 3-Apr-23 | 4-Apr-23 | 20-Apr-23 | $1.15 | 6.65% |

| 3-Jan-23 | 4-Jan-23 | 18-Jan-23 | $1.09 | 6.38% |

| 3-Oct-22 | 4-Oct-22 | 18-Oct-22 | $1.90 | 6.00% |

| 1-Jul-22 | 4-Jul-22 | 18-Jul-22 | $3.52 | 5.65% |

| 1-Apr-22 | 4-Apr-22 | 20-Apr-22 | $1.30 | 3.90% |

| 4-Jan-22 | 5-Jan-22 | 19-Jan-22 | $0.79 | 3.75% |

| 1-Oct-21 | 4-Oct-21 | 18-Oct-21 | $1.70 | 3.52% |

| 1-Jul-21 | 2-Jul-21 | 16-Jul-21 | $0.57 | 3.10% |

| 1-Apr-21 | 6-Apr-21 | 20-Apr-21 | $0.89 | 3.12% |

| 4-Jan-21 | 5-Jan-21 | 19-Jan-21 | $0.62 | 2.47% |

How to Buy and Sell A200 ETF Units

Investing in the A200 ETF is as simple as buying and selling its units on the Australian Securities Exchange (ASX) through a broker or online trading platform. Like any stock trade, you’ll need to factor in brokerage fees, and the bid-ask spread when placing your orders.

It’s important to note that the A200 ETF is designed for long-term investors seeking broad exposure to the Australian equity market. While you can buy and sell units at any time during trading hours, frequent trading may incur additional costs and potentially undermine the benefits of the fund’s low-cost structure.

Is the A200 ETF Right for You?

Whether the BetaShares A200 ETF is a suitable investment for you depends on your individual goals, risk tolerance, and overall investment strategy. Here are a few key considerations:

- Diversification: If you’re looking to gain diversified exposure to the Australian stock market, the A200 ETF could be an excellent addition to your portfolio.

- Cost-effectiveness: The fund’s low management fees and passive investment strategy make it a cost-effective way to invest in Australian equities.

- Risk tolerance: As an equity fund, the A200 ETF carries the inherent risks associated with stock market investments, including volatility and potential loss of capital.

- Investment horizon: The fund is designed for long-term investors who can weather short-term market fluctuations.

Does A200 ETF pay dividends?

Yes, the A200 ETF pays quarterly distributions to its unitholders, which primarily consist of the dividends received from the underlying Australian companies in the fund’s portfolio. The dividend yield has historically averaged around 4% per annum, providing a potential source of income for investors.

What companies are in A200?

The A200 ETF aims to track the S&P/ASX 200 Index, which means its portfolio consists of shares in the 200 largest companies listed on the Australian Securities Exchange (ASX). Some of the top holdings include Commonwealth Bank, BHP Group, CSL Limited, Westpac Banking Corporation, and National Australia Bank. The fund’s holdings span various sectors, with financials, materials, and healthcare being the largest allocations.

Is BetaShares Australia 200 ETF a good investment?

Whether the A200 ETF is a good investment depends on an individual’s investment goals, risk tolerance, and overall portfolio strategy. The fund provides a cost-effective and diversified way to gain exposure to the Australian equity market. However, like any equity investment, it carries inherent risks, including market volatility and potential loss of capital. Investors should carefully consider their circumstances and seek professional advice if needed.

What is the management fee for A200 ETF?

The A200 ETF charges a management fee of 0.04% per annum, which is significantly lower than the fees typically charged by actively managed mutual funds. However, investors may also incur additional costs, such as brokerage fees when buying or selling units on the ASX and the bid-ask spread.

Explore other ETF options in our Shares & ETFs section. Find a wide range of ETFs to suit your investment preferences and goals. You can also check our property investment articles for more opportunities.

Share Your Thoughts and Experiences

Have you invested in the A200 ETF or other Australian ETFs? What has been your experience? Do you prefer passive index-tracking funds like the A200, or do you favor actively managed funds? Share your thoughts, questions, and insights in the comments below.

We’d also love to hear your feedback on this article. Did you find it informative and engaging? Are there any additional topics or aspects of the A200 ETF you’d like us to cover? Your input helps us create even better content for the Aussie investing community.

Remember, investing involves risks, and it’s crucial to conduct your own research and seek professional advice before making any investment decisions. The A200 ETF may or may not be the right fit for your specific circumstances, but we hope this review has provided you with a comprehensive understanding of this popular Australian ETF.

Happy investing, and stay tuned for more insightful content from our team!

Important Disclaimer: Not a Licensed Financial Advisor

The information and insights provided in this document are intended solely for educational and informational purposes. It’s imperative to understand that I am not a licensed financial advisor, tax expert, or investment strategist. The contents herein are crafted to offer a general overview and should not be construed as personalized financial advice.

Before making any financial decisions or embarking on investment ventures, it’s crucial to consult with a professional financial advisor or a certified tax consultant who is well-equipped to understand your unique financial landscape. Engaging with a licensed professional ensures that the advice you receive is tailored to your specific financial goals, risk tolerance, and tax obligations, adhering to the compliance and guidelines established by regulatory authorities, including the Australian Taxation Office (ATO) and other relevant bodies.

Financial markets are complex and dynamic and involve various degrees of risk. Therefore, thorough due diligence and professional guidance are essential to navigate these waters effectively. This content does not represent the opinions or endorsements of any financial institutions or regulatory agencies. Remember, the responsibility for financial decisions lies with the individual, and seeking qualified advice is the best step towards informed decision-making and achieving financial objectives.

2 thoughts on “Betashares A200 ETF Review: Unleash Financial Success Now!”