The Betashares Diversified All Growth ETF (DHHF) is a unique investment solution that aims to provide investors with low-cost exposure to a diversified portfolio focused on high-growth potential. As an exchange-traded fund (ETF), DHHF offers a convenient and cost-effective way to gain broad exposure to global equity markets, making it an attractive option for investors seeking long-term capital growth.

What is an ETF?

First things first, ETF stands for Exchange Traded Fund. Think of it as a basket of stocks or bonds that you can buy and sell on the stock market. DHHF is one such basket that focuses on stocks aiming for growth.

What is the DHHF ETF?

The DHHF ETF, managed by BetaShares Capital Ltd, is a fund that aims to provide investors with low-cost exposure to a diversified portfolio entirely focused on growth assets. It is traded on the Australian Securities Exchange under the ticker DHHF and offers a practical solution for those seeking to invest in a blend of large, mid, and small-cap equities across global markets.

Investment Strategy and Asset Allocation

DHHF’s Investment Approach:

DHHF’s strategy is simple yet effective. It invests 100% of its assets in equities, targeting a mix of Australian and international stocks. The ETF is constructed using a passive investment approach, comprising various cost-effective ETFs traded on the ASX and other global exchanges.

Asset Allocation Breakdown:

| Region | Allocation |

| Australian Equities | 36.4% |

| US Equities | 39.0% |

| Developed Markets – ex-US | 18.4% |

| Emerging Markets | 6.3% |

This allocation provides broad exposure to around 8,000 equity securities listed on more than 60 global exchanges, ensuring a comprehensive global reach and diversification. This diversified portfolio is regularly reviewed and adjusted to ensure it remains in line with the fund’s objectives.

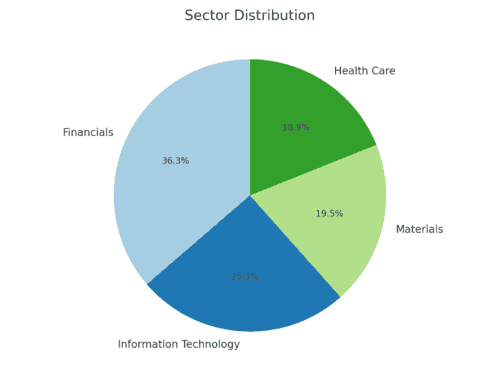

Sector Allocation DHHF’s sector allocation is also well-diversified, with the largest exposures being:

- Financials: 20.7%

- Information Technology: 14.4%

- Materials: 11.1%

- Health Care: 10.8%

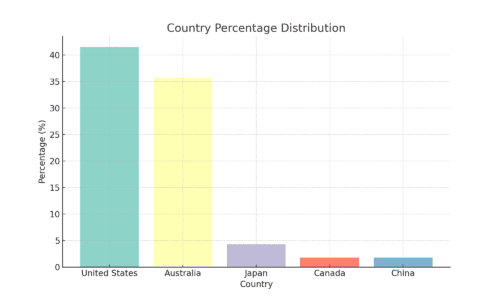

Country Allocation The fund’s country allocation is similarly diversified, with the largest exposures being:

- United States: 41.5%

- Australia: 35.7%

- Japan: 4.3%

- Canada: 1.8%

- China: 1.8%

Performance and Costs

Performance Metrics

The DHHF ETF has shown robust performance over the years. As of the latest data in 2024, the fund reported a significant annual return, underscoring its potential for high growth in the long term. Here’s a look at its recent performance:

| Time Period | Return |

| 1-Year | 21.16% |

| 3-Year Annualized | 10.82% |

| Since Inception | 11.56% |

Fees and Costs

One of DHHF’s most attractive features is its low management fee of 0.19% per annum, which is competitively priced within the diversified ETF market. This fee structure makes DHHF an appealing option for cost-conscious investors.

Risks and Considerations

Like any investment, DHHF comes with its set of risks, which include market volatility, currency fluctuations, and the inherent risks associated with the underlying ETFs and index tracking. These risks are crucial for investors to consider, especially those with a high tolerance for risk and a long-term investment horizon.

Distribution and Yield

DHHF offers quarterly distributions, which are a part of its appeal to investors looking for regular income in addition to growth potential. The recent 12-month distribution yield stands at approximately 2.2%, reflecting a steady income stream for its investors.

Why Choose DHHF?

High Growth Potential: Investing in DHHF means investing in a portfolio geared entirely towards growth, making it suitable for investors who are in a position to handle potential market fluctuations in exchange for higher returns.

Diversified Exposure: With exposure to thousands of equities across a plethora of markets worldwide, investors benefit from a risk spread that can potentially lead to smoother returns over time.

Low Cost: The low management fee is a significant advantage, allowing investors to keep more of their returns compared to higher-cost alternatives.

Who is DHHF Suitable For?

DHHF may be suitable for investors with a high tolerance for risk and an investment timeframe of at least 5 years. The fund’s 100% allocation to growth assets makes it an appropriate choice for investors seeking long-term capital appreciation.

Advantages of Investing in DHHF

- High Growth Potential: DHHF’s focus on growth assets, such as global equities, provides investors with the potential for substantial capital appreciation over the long term.

- Diversification: The fund’s exposure to a broad range of global equity markets helps to diversify risk and reduce portfolio volatility.

- Low Cost: With a management fee of just 0.19% per annum, DHHF is one of the most cost-effective all-in-one diversified ETFs on the Australian market.

- Convenience: As an ETF, DHHF can be bought and sold on the ASX like a regular share, making it a convenient investment option for investors.

Comparison to Other Diversified ETFs When compared to other diversified ETFs, such as the Vanguard Diversified High Growth Index ETF (VDHG), DHHF stands out for its:

- Higher allocation to growth assets (100% vs. 90% for VDHG)

- Lower management fee (0.19% vs. 0.27% for VDHG)

- Broader global exposure, with around 8,000 underlying securities

This positioning makes DHHF a compelling choice for investors seeking a more aggressive, high-growth exposure within their diversified portfolio.

In conclusion, the BetaShares Diversified All Growth ETF (DHHF) presents a compelling option for investors seeking a growth-focused investment. It offers an easy, cost-effective way to achieve diversified exposure to global equities, suitable for those with a long-term perspective and a higher tolerance for risk. As always, potential investors should consider their own financial situation and consult with a financial advisor to ensure that this ETF aligns with their investment objectives and financial goals.

FAQs About DHHF

What does DHHF ETF invest in?

DHHF invests in a diversified portfolio of equities across Australia, the US, and other developed and emerging markets.

How is DHHF ETF traded?

DHHF is traded like any stock on the ASX under the ticker DHHF.

What are the risks associated with DHHF ETF?

Risks include market risk, currency risk, and risks associated with underlying ETFs and index tracking.

How often does DHHF ETF distribute dividends?

DHHF distributes dividends quarterly.

Who manages DHHF ETF?

DHHF is managed by BetaShares Capital Ltd.

Is DHHF ETF a good long-term investment?

Based on past performance, DHHF has shown solid long-term growth with a return of 11.56% since its inception and a 3-year annualized return of 10.82%. It aims for high growth by investing 100% in equities, which can be suitable for long-term investors with a high risk tolerance.

Is DHHF ETF high risk?

Yes, DHHF can be considered high risk as it is 100% invested in growth assets like stocks, which are subject to market fluctuations. It’s designed for investors with a high tolerance for risk who are comfortable with the potential for significant value changes in their investment.

What are the fees for DHHF ASX?

DHHF has a management fee of 0.19% per annum. This fee is competitively low for an all-in-one diversified ETF on the Australian market, making it an attractive option for cost-conscious investors.

Is DHHF ETF a managed investment?

DHHF is a passively managed investment, meaning it aims to replicate the performance of its benchmark indices rather than outperforming the market through active management. It uses a blend of underlying ETFs to achieve its investment objectives.

Is DHHF ETF tax efficient?

ETFs like DHHF can be tax-efficient due to their structure, which generally allows for lower capital gains distributions compared to actively managed funds. However, individual tax efficiency depends on factors such as the investor’s tax bracket and investment horizon.

Why invest in DHHF ETF?

Investors might choose DHHF for its low-cost exposure to a diversified portfolio of growth assets, its potential for high growth, and its straightforward investment strategy. It’s designed for investors seeking an easy way to gain access to a broad range of global equities.

What does DHHF ETF invest in?

DHHF invests in approximately 8,000 equity securities across global markets, including Australian equities, U.S. equities, developed markets excluding the U.S., and emerging markets. It’s an all-equity ETF with a 100% allocation to shares.

What is the asset allocation of DHHF DHHF?

DHHF’s asset allocation is as follows:

Australian Equities: 36.4%

US Equities: 39.0%

Developed Markets (ex-US): 18.4%

Emerging Markets: 6.2%

How does DHHF compare to other diversified ETFs?

Compared to other diversified ETFs, such as VDHG, DHHF stands out for its higher allocation to growth assets (100% vs. 90%), lower management fee (0.19% vs. 0.27%), and broader global exposure (around 8,000 underlying securities).

How can I invest in DHHF ETF?

DHHF can be bought and sold on the ASX like a regular share. There is no minimum investment required, and investors can purchase units through their stockbroker or online trading platform.

Expand Your Financial Knowledge: Visit our Personal Finance section for essential tips, delve into Property Investing for the latest market insights, or explore our comprehensive Resources for educational articles and tools. If you’re interested in the stock market, our Shares & ETFs section offers a range of options to suit your investment goals. Dive into these areas to enhance your financial understanding and decision-making.

Disclaimer

Not a Licensed Financial Advisor

The information and insights provided in this document are intended solely for educational and informational purposes. It’s imperative to understand that I am not a licensed financial advisor, tax expert, or investment strategist. The contents herein are crafted to offer a general overview and should not be construed as personalized financial advice.

Affiliate Disclosure: Some of the links on this blog may be affiliate links. This means if you click on the link and purchase a product or service, I may receive a commission at no additional cost to you. I only recommend products or services that I believe in, and that may be helpful to my readers.

Before making any financial decisions or embarking on investment ventures, it’s crucial to consult with a professional financial advisor or a certified tax consultant who is well-equipped to understand your unique financial landscape. Engaging with a licensed professional ensures that the advice you receive is tailored to your specific financial goals, risk tolerance, and tax obligations, adhering to the compliance and guidelines established by regulatory authorities, including the Australian Taxation Office (ATO) and other relevant bodies.

Financial markets are complex and dynamic and involve various degrees of risk. Therefore, thorough due diligence and professional guidance are essential to navigate these waters effectively. This content does not represent the opinions or endorsements of any financial institutions or regulatory agencies. Remember, the responsibility for financial decisions lies with the individual, and seeking qualified advice is the best step towards informed decision-making and achieving financial objectives.