If you’re an Australian looking for an easy and affordable way to save for retirement, Vanguard Super could be the perfect choice for you. Known globally as a leading investment company, Vanguard offers a top-rated superannuation fund in Australia.

In this comprehensive Vanguard Super review, we’ll cover everything you need to know about superannuation, how Vanguard’s super fund works, the fees and investment options, performance, insurance options, and more. We’ll keep things straightforward and easy to understand so you can decide if Vanguard is the right super fund for your retirement savings.

What is Superannuation?

Superannuation, commonly referred to as “super,” is a system in Australia designed to help residents save for retirement. Employers are legally required to contribute a portion of your salary or wages into a super fund. This money is then invested, growing over time until you retire, providing you with funds for your retirement years.

Vanguard in Australia

Vanguard has been a major player in the global investment scene and has made significant inroads into the Australian market. Known for its low-cost, high-value investment philosophy, Vanguard aims to empower Australian investors by providing transparent, affordable, and effective superannuation options.

What is the Vanguard Super Fund?

Vanguard Super is an industry super fund, meaning it is a low-cost, profit-for-members fund run solely to benefit its members—you! As of 2024, Vanguard Super boasts over 560,000 members and manages more than $28 billion in assets, making it one of the largest and most popular super funds in Australia.

Vanguard Superannuation Benefits

Vanguard Super SaveSmart stands out for its simplicity and effectiveness. It offers easy-to-understand, flexible investment options along with insurance covers that cater to various needs. Whether you’re looking for basic coverage or more comprehensive protection, Vanguard provides options to keep your retirement savings secure.

How Super Works with Vanguard

Vanguard simplifies superannuation with clear, straightforward processes. Contributions are made easily through the Superannuation Guarantee, and Vanguard’s tax-effective strategies enhance your long-term savings. The default Lifecycle investment option adjusts your asset allocation based on your age, making it a hassle-free choice for those who prefer not to actively manage their super.

Detailed Investment Options

Vanguard Super offers a variety of investment choices tailored to meet individual financial goals and risk preferences. Whether you’re a hands-off investor or someone who likes to tailor their portfolio, understanding the nuances of each option can empower you to make informed decisions. Below is a detailed comparison of Vanguard Super’s three main investment types: Lifecycle, Diverse, and Single Sector.

Lifecycle Investments:

Vanguard’s Lifecycle investment strategy is designed to automatically adjust its asset allocation as you age. This means it starts with a focus on growth investments when you are younger and gradually shifts to more conservative investments as you approach retirement, ensuring that the investment risk is reduced as you near this critical phase of life.

Diversified Investments

Vanguard offers a range of Diversified investment options, each designed to cater to different risk tolerances:

- High Growth: Targets significant capital appreciation over the long term through a heavy allocation in growth assets like equities.

- Ethically Conscious Growth: Focuses on investments that meet ethical standards, balancing growth with social responsibility.

- Growth: A mix of growth and defensive assets designed to build wealth with some protection against market downturns.

- Balanced: Aims for steady returns by balancing growth and income assets.

- Conservative: Focuses on stability and preservation of capital through a higher allocation in defensive assets.

Single Sector Investments

For those who prefer to have more control over their investment allocations, Vanguard’s Single Sector options include:

- Australian Shares: Invests in ASX-listed companies, offering high growth potential.

- International Shares: Provides exposure to global markets for diversification and growth.

- International Shares (Hedged): Offers global exposure with reduced currency risk.

- Australian Fixed Interest: Focuses on lower-risk securities like government and corporate bonds.

- Global Fixed Interest (Hedged): Bonds from global markets with hedged currency risk.

- Cash: Involves low-risk short-term debt securities for minimal risk exposure.

Comparison Tables

The following tables provide a quick overview of the fees, objectives, and asset allocations for each investment option, helping you compare and decide which fits your investment strategy and risk tolerance.

Lifecycle

| Feature | Lifecycle |

| Automatic Adjustment | Yes |

| Investment Focus | Age-based allocation |

| Risk Level | Decreases with age |

| Yearly Fee | 0.58% |

| Objective | CPI + varying percentage |

Diversified

| Investment Option | Yearly Fee | Objective | Growth/Defensive Allocation |

| High Growth | 0.56% | CPI + 3.75% | 90% / 10% |

| Ethically Conscious Growth | 0.58% | CPI + 3.50% | 70% / 30% |

| Growth | 0.56% | CPI + 3.50% | 70% / 30% |

| Balanced | 0.56% | CPI + 3.00% | 50% / 50% |

| Conservative | 0.56% | CPI + 2.75% | 30% / 70% |

Single Sector

| Investment Option | Yearly Fee | Objective | Growth/Defensive Allocation |

| Australian Shares | 0.58% | Match S&P ASX300 Index | 100% / 0% |

| International Shares | 0.58% | Match MSCI World ex Australia | 100% / 0% |

| International Shares (Hedged) | 0.58% | Match MSCI World ex Australia (Hedged) | 100% / 0% |

| Australian Fixed Interest | 0.58% | Match Bloomberg AusBond Composite | 0% / 100% |

| Global Fixed Interest (Hedged) | 0.58% | Match Bloomberg Global Aggregate (Hedged) | 0% / 100% |

| Cash | 0.39% | Match Bloomberg AusBond Bank Bill | 0% / 100% |

This comprehensive overview ensures that whether you’re starting out, looking to consolidate your super, or fine-tuning your investment strategy as you approach retirement, you can find a Vanguard Super option that aligns with your financial goals and risk tolerance.

Fees and Costs

Vanguard Super SaveSmart is known for its cost-effectiveness. The fee structure is transparent, with no hidden charges, making it one of the most competitive options in the market. Understanding these fees is crucial as they can significantly impact your long-term returns.

Yearly Fee Composition

- Administration Fee (0.35%): This is the fee for the day-to-day operations and management of your super account.

- Investment Fee (Varies): This cost is associated with managing your investments. It varies based on the investment option you choose, but for most options, it’s around 0.21%.

- Transaction Fee (Up to 0.03%): These are costs incurred for the buying and selling of investments within your fund.

The sum of these fees is your yearly fee. It’s important to note that investment and transaction costs are estimates, and the actual costs could vary. For the most accurate information, refer to our Product Disclosure Statement.

Fee Calculation Example

To calculate your yearly fee, multiply your super balance by the total fee percentage. For instance, a super balance of $50,000 with a fee of 0.58% would result in a yearly fee of $290.

Special Fees and Considerations

- Activity Fees: Certain activities, such as switching investment options, may incur additional fees.

- Insurance Premiums: If you opt for insurance cover through your super, the cost will be an additional deduction from your balance.

Diversified and Single Sector Fees

For each of our investment options, whether it’s the age-adjusting Lifecycle option or the Single Sector choices like ‘Australian Shares’ or ‘Cash’, Vanguard offer competitive and clear-cut fees. Lifecycle option, for example, has a yearly fee of just 0.58%, while our ‘Cash’ investment option has an even lower fee of 0.39%.

| Investment Option | Administration Fee | Investment Fee* | Transaction Fee* | Total Yearly Fee |

| Lifecycle | 0.35% | 0.21% | 0.02% | 0.58% |

| High Growth | 0.35% | 0.21% | 0.00% | 0.56% |

| Ethically Conscious Growth | 0.35% | 0.22% | 0.01% | 0.58% |

| Balanced | 0.35% | 0.21% | 0.00% | 0.56% |

| Conservative | 0.35% | 0.21% | 0.00% | 0.56% |

| Australian Shares | 0.35% | 0.20% | 0.03% | 0.58% |

| International Shares | 0.35% | 0.21% | 0.02% | 0.58% |

| International Shares (hedged) | 0.35% | 0.21% | 0.02% | 0.58% |

| Australian Fixed Interest | 0.35% | 0.21% | 0.02% | 0.58% |

| Global Fixed Interest (hedged) | 0.35% | 0.21% | 0.02% | 0.58% |

| Cash | 0.35% | 0.04% | 0.00% | 0.39% |

* Investment and transaction fees may vary; please refer to the latest Product Disclosure Statement for the most accurate figures.

These competitive fees mean more of your money stays invested and growing, significantly impacting your retirement savings over time.

Performance

Diversified

Vanguard Super offers a range of diversified investment options that are designed to cater to different risk preferences. These pre-mixed portfolios allow for an easy adjustment according to your risk appetite and retirement goals. Launched on 5th October 2022, these options have shown promising performance up to 31st March 2024, with the ‘High Growth’ option yielding a remarkable 16.96% in the first year. The ‘Ethically Conscious Growth’ option, which factors in ethical investment considerations, also performed well, offering a return of 15.59% over the same period. For those looking for a balance between risk and return, the ‘Balanced’ option provided a steady 9.85% return in its first year. Lastly, for members inclined towards a more cautious approach, the ‘Conservative’ option delivered a respectable 6.63% return.

| Investment Option | Launch Date | Since Launch | 1 Month | 3 Months | 6 Months | 1 Year |

| High Growth | 05 Oct 2022 | 15.98% | 2.63% | 7.28% | 14.04% | 16.96% |

| Ethically Conscious Growth | 05 Oct 2022 | 14.29% | 2.05% | 6.44% | 13.75% | 15.59% |

| Growth | 05 Oct 2022 | 12.82% | 2.16% | 5.50% | 11.68% | 13.28% |

| Balanced | 05 Oct 2022 | 9.87% | 1.79% | 3.88% | 9.57% | 9.85% |

| Conservative | 05 Oct 2022 | 7.02% | 1.33% | 2.32% | 7.15% | 6.63% |

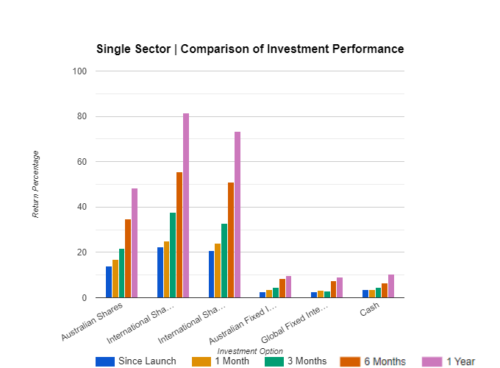

Single Sector

Vanguard Super’s Single Sector investment options are the building blocks for members who prefer to construct their super investment strategy. Since their inception on October 5, 2022, these options have catered to various preferences and risk tolerances. For instance, the ‘International Shares’ option has been a standout performer, delivering a 25.80% return in the first year. This is followed closely by the ‘International Shares (hedged)’ option, which saw a 22.38% return, mitigating currency risk. More conservative options like ‘Australian Fixed Interest’ and ‘Global Fixed Interest (hedged)’ have provided modest but stable returns of 1.12% and 1.63%, respectively, while the ‘Cash’ option has yielded a return of 3.75% over the year, suiting those seeking minimal risk exposure.

| Investment Option | Launch Date | Since Launch | 1 Month | 3 Months | 6 Months | 1 Year |

| Australian Shares | 05 Oct 2022 | 13.83% | 2.95% | 4.92% | 12.95% | 13.77% |

| International Shares | 05 Oct 2022 | 22.36% | 2.67% | 12.59% | 17.96% | 25.80% |

| International Shares (hedged) | 05 Oct 2022 | 20.92% | 2.98% | 9.05% | 18.00% | 22.38% |

| Australian Fixed Interest | 05 Oct 2022 | 2.66% | 0.94% | 0.85% | 4.08% | 1.12% |

| Global Fixed Interest (hedged) | 05 Oct 2022 | 2.67% | 0.72% | -0.54% | 4.46% | 1.63% |

| Cash | 05 Oct 2022 | 3.43% | 0.30% | 0.96% | 1.92% | 3.75% |

Starting a Super Account with Vanguard

Switching to Vanguard is straightforward and can be done online in less than 15 minutes. Vanguard also assists with rolling over or transferring existing super balances and tracking down any lost or unclaimed super accounts, consolidating them into one Vanguard account for simplicity.

Starting with Vanguard:

- Eligibility Check: Ensure you meet the basic criteria.

- Documentation: Gather necessary personal and financial documents.

- Application Process: Complete the online application or contact Vanguard for assistance.

- Fund Transfer: If transferring from another fund, Vanguard assists throughout the process to ensure a smooth transition.

Easy Online Account Management

Managing your super is effortless with Vanguard’s user-friendly online member portal and mobile app, where you can view your balance, update your investment strategy, adjust insurance coverage, and more, all at your convenience.

Insurance Options in Vanguard Super

Vanguard Super offers a suite of affordable insurance options to provide financial security for you and your family. Members are automatically entitled to a basic level of Death and Terminal Illness Cover, as well as Total & Permanent Disability (TPD) Cover. These covers are designed to offer peace of mind with premiums conveniently deducted from the super balance, ensuring no direct out-of-pocket expense.

Income Protection Insurance

In addition to the default cover, Vanguard Super facilitates Income Protection insurance for those who are eligible. This cover is optional and requires a separate application process, reflecting Vanguard’s approach to keeping default cover affordable and preventing the undue erosion of retirement savings.

Customizable Insurance Coverage

Vanguard Super recognizes that life’s circumstances change, which is why it offers flexible insurance options that members can tailor to their specific needs. Whether it’s adjusting the level of cover or applying for additional protection, these changes can be managed directly through the online account.

Eligibility and Advice

Eligibility for Vanguard Super’s default insurance cover is contingent upon meeting certain conditions. For detailed eligibility criteria and the specifics of different insurance covers, it’s recommended to review the ‘Insurance in your super’ guide provided by Vanguard. Those seeking advice on the right level or type of insurance to suit their individual situation may benefit from consulting with a financial adviser.

Premium Calculations and Options for Existing Coverage

The premiums for Vanguard Super insurance are calculated based on a variety of factors, including age, gender, and occupation. Members with existing cover from another super fund have the flexibility to transfer it to Vanguard Super, maintain their current cover, or opt out of Vanguard’s default insurance upon joining. Any modifications to insurance coverage can be done at any point, offering a customizable approach to protection.

Compliance and Transparency

Vanguard operates with strict adherence to Australian superannuation regulations, ensuring all operations are transparent and compliant. This commitment to transparency is a key reason many Australians trust Vanguard with their retirement savings.

Pros & Cons

Pros of Vanguard Super:

- Low management fees

- Flexible investment choices

- Easy online account management

- Strong long-term investment performance

- Affordable insurance options

- Simple to join or consolidate other super accounts

Cons of Vanguard Super:

- Limited to index funds, no active management

- No physical branch locations

- Could enhance educational tools on the website

Conclusion

Vanguard Super SaveSmart emerges as a standout for superannuation management and is known for its robust performance and user-friendly interface. With competitive fees that keep costs low and a range of investment options that cater to varying risk preferences, it provides a practical solution for Australians focused on growing their retirement savings. The added benefit of customizable insurance cover further secures its position as a comprehensive and versatile choice for those planning for a financially sound future.

FAQ’s

What are the main types of investment options offered by Vanguard Super?

Vanguard Super offers three main types of investment options: Lifecycle, Diversified, and Single Sector. Lifecycle investments automatically adjust based on your age; diversified investments include pre-mixed portfolios like High Growth and Conservative, and Single Sector investments focus on specific asset classes.

How does the Lifecycle investment option work?

The Lifecycle option is designed to adjust the asset allocation automatically as you age. It focuses on growth investments in the early years and gradually shifts towards more defensive investments as you approach retirement, optimizing your portfolio based on your changing risk tolerance.

Can I choose a specific investment strategy with Vanguard Super?

Yes, Vanguard Super allows you to choose from various investment strategies under its Diversified and Single Sector options. You can opt for aggressive growth strategies, ethically conscious investments, or more conservative approaches depending on your personal financial goals and risk tolerance.

What are the fees associated with Vanguard Super investment options?

The fees vary depending on the chosen investment option but are generally competitive within the industry. Fees are composed of administration, investment, and transaction costs, with specific percentages detailed in the fund’s Product Disclosure Statement (PDS).

How can I change my investment options within Vanguard Super?

You can change your investment options at any time through Vanguard Super’s online platform. This allows you to adjust your portfolio according to your life stage, financial goals, or changes in risk preference.

Are there any risks involved with investing in Vanguard Super?

As with all investments, there are inherent risks associated with Vanguard Super’s options. The level of risk varies depending on the specific investment option chosen, with higher growth options typically having higher volatility and conservative options focusing on preserving capital.

What are the expected returns for Vanguard Super’s investment options?

Expected returns vary by investment option and are influenced by market conditions. Each option has a specific objective, such as achieving a return above the Consumer Price Index (CPI) by a certain percentage over a rolling 10-year period. Details on historical and expected returns can be found in the fund’s PDS.

How can I monitor the performance of my investments with Vanguard Super?

Vanguard Super provides an online account management portal where members can monitor their investment performance, view account balances, and receive detailed reports on their investments.

Is there a minimum investment period for Vanguard Super’s investment options?

Generally, there is no fixed minimum investment period for Vanguard Super; however, some investment strategies are designed for longer-term horizons to achieve optimal returns. It’s recommended to consider your investment time frame when selecting an option.

Can I combine different investment options within Vanguard Super?

Yes, members have the flexibility to combine different investment options to tailor their portfolio to their unique financial needs and investment goals.

Is Vanguard Superfund good?

Vanguard Super fund is considered a good choice for many investors due to its low-cost structure, diverse investment options, and strong historical performance. Vanguard’s reputation for transparency and investor-centric practices further supports its standing as a reliable superannuation fund provider.

Does Vanguard offer superannuation?

Yes, Vanguard offers superannuation services in Australia. Known for its range of investment products, Vanguard provides superannuation options that cater to various investment preferences and retirement planning needs.

What are the cons of Vanguard?

Answer: Some potential cons of Vanguard include:

Limited Active Management Options: Vanguard is predominantly known for its index funds and passive management strategy, which may not appeal to investors seeking active fund management.

No Personalized Financial Advice: Vanguard typically does not offer personalized financial advice with its lower-cost accounts, which may be a drawback for those seeking more personalized investment guidance.

Online Interface: Some users find Vanguard’s online platform and mobile app less intuitive compared to those of other financial institutions.

Is my money safe at Vanguard?

As with any investment, there are risks involved, but Vanguard is considered one of the safest investment firms globally due to its conservative investment approach and robust regulatory compliance. It is also important to note that investment securities are not federally insured against market losses.

Who owns Vanguard Super?

Vanguard Super is owned by The Vanguard Group, Inc., which is a unique structure as it is owned by its U.S. domiciled funds and, by extension, the shareholders of those funds. This structure aligns the interests of Vanguard with those of its investors.

Is Vanguard an Australian company?

No, Vanguard is not originally an Australian company. It is an American investment management company based in Malvern, Pennsylvania. However, Vanguard has a significant presence in Australia, offering a wide range of investment products and services, including superannuation.

Expand Your Financial Knowledge: Visit our Personal Finance section for essential tips, delve into Property Investing for the latest market insights, or explore our comprehensive Resources for educational articles and tools. If you’re interested in the stock market, our Shares & ETFs section offers a range of options to suit your investment goals. Dive into these areas to enhance your financial understanding and decision-making.

Disclaimer

Not a Licensed Financial Advisor

The information and insights provided in this document are intended solely for educational and informational purposes. It’s imperative to understand that I am not a licensed financial advisor, tax expert, or investment strategist. The contents herein are crafted to offer a general overview and should not be construed as personalized financial advice.

Affiliate Disclosure: Some of the links on this blog may be affiliate links. This means if you click on the link and purchase a product or service, I may receive a commission at no additional cost to you. I only recommend products or services that I believe in, and that may be helpful to my readers.

Before making any financial decisions or embarking on investment ventures, it’s crucial to consult with a professional financial advisor or a certified tax consultant who is well-equipped to understand your unique financial landscape. Engaging with a licensed professional ensures that the advice you receive is tailored to your specific financial goals, risk tolerance, and tax obligations, adhering to the compliance and guidelines established by regulatory authorities, including the Australian Taxation Office (ATO) and other relevant bodies.

Financial markets are complex and dynamic and involve various degrees of risk. Therefore, thorough due diligence and professional guidance are essential to navigate these waters effectively. This content does not represent the opinions or endorsements of any financial institutions or regulatory agencies. Remember, the responsibility for financial decisions lies with the individual, and seeking qualified advice is the best step towards informed decision-making and achieving financial objectives.

1 thought on “Vanguard Super Review”