As a novice investor, you may have heard about exchange-traded funds (ETFs) but aren’t quite sure what they entail. Simply put, an ETF is a type of investment fund that holds a basket of underlying assets, such as stocks, bonds, or a combination of both. ETFs are traded on stock exchanges, just like individual stocks, allowing investors to buy and sell shares throughout the trading day.

Introduction to Vanguard’s Growth Index Fund ETF

VDHG, or the Vanguard Diversified High Growth Index ETF, represents a world of growth potential. Designed by Vanguard’s veteran portfolio managers, this ETF offers a ready-made solution for those with a high-risk appetite and a vision of long-term capital growth.

Overview of VDHG

The Vanguard Diversified High Growth Index ETF (VDHG) is a unique investment product that offers exposure to a diversified portfolio of assets in a single fund. Traded on the Australian Securities Exchange (ASX), VDHG is designed for investors with a high tolerance for risk who are seeking long-term capital growth.

What Sets VDHG Apart in the Market

VDHG stands out in the market for its simple yet effective approach to investing. By combining various Vanguard index funds into one ETF provides instant diversification across multiple asset classes and markets. This one-stop solution eliminates the need for investors to construct and rebalance their own portfolios, making VDHG an attractive option for those seeking a hassle-free investment experience.

VDHG’s Investment Strategy Decoded

VDHG is a portfolio that combines multiple asset classes, each carefully chosen to play a vital role in achieving a balanced and high-growth investment. This blend is not fixed but rather a dynamic ensemble that adapts to the changing rhythms of the global market, ensuring that the portfolio remains strong and resilient.

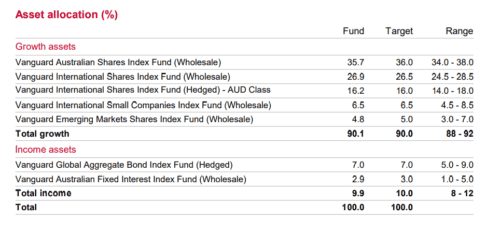

Asset Allocation and Diversification

One of the key advantages of VDHG is its passive investment approach. As an index fund, VDHG tracks a predetermined basket of underlying indexes rather than relying on active management. This passive strategy results in lower management fees (0.27% p.a.) compared to actively managed funds, potentially leading to higher long-term returns.

Growth vs. Income Assets: The Balancing Act

VDHG follows a strategic asset allocation strategy, targeting a 90% allocation to growth assets (such as Australian and international shares) and a 10% allocation to income-producing assets (like bonds). This allocation aims to strike a balance between capital growth potential and income generation while maintaining a high-growth investment profile.

Geographic and Sector Exposure

VDHG’s portfolio is well-diversified across geographic regions and sectors. It provides exposure to Australian equities through the Vanguard Australian Shares Index Fund (35.7%), international equities through the Vanguard International Shares Index Funds (26.9% and 16.2%), and emerging markets through the Vanguard Emerging Markets Shares Index Fund (4.81%). Additionally, it includes allocations to global and Australian fixed-income instruments for income and stability.

Strategic Asset Allocation: The Backbone of VDHG

VDHG’s investment strategy revolves around its strategic asset allocation, which is regularly rebalanced to maintain the target weightings across the underlying funds. This approach ensures that the ETF’s risk and return characteristics remain aligned with its investment objective, providing a disciplined and systematic approach to portfolio management.

Simplicity Meets Growth: VDHG’s One-Stop Investment Solution

For novice investors seeking long-term capital growth, VDHG offers a convenient and straightforward solution. By investing in a single ETF, you gain exposure to a well-diversified portfolio of assets without the need to manage multiple individual investments. This simplicity allows you to focus on your long-term investment goals while leaving the intricacies of asset allocation and rebalancing to the experts at Vanguard.

Vanguard High Growth Index Fund Performance

Navigating Through Market Volatility: Performance Over the Years

Short-term vs. Long-term Returns

Over the past year (as of February 2024), VDHG delivered a total return of 16.99%, performing slightly below its benchmark index. However, investors should note that short-term performance can be influenced by market fluctuations. When viewed from a longer-term perspective, VDHG’s performance demonstrates its ability to navigate market volatility and provide consistent returns. Over a 5-year period, the ETF returned 9.29% per annum, closely tracking its benchmark’s 9.77% return.

| Month | YTD | 1 year | 3 years (p.a.) | 5 years (p.a.) | 10 years (p.a.) | ^Inception (p.a.) | |

|---|---|---|---|---|---|---|---|

| Total | 3.19% | 5.03% | 16.99% | 8.79% | 9.29% | — | 8.69% |

| Gross | 3.21% | 5.08% | 17.30% | 9.08% | 9.59% | — | 8.98% |

| Benchmark | 3.23% | 5.09% | 17.36% | 9.20% | 9.77% | 9.39% | 9.12% |

Benchmark Comparison and Analysis

VDHG’s performance is measured against the High Growth Composite Index, a blended benchmark that reflects the ETF’s strategic asset allocation. While there may be periods of over or underperformance relative to the benchmark, VDHG’s passive investment approach aims to closely track the benchmark’s performance over the long term, benefiting from the diversification and low-cost advantages of indexing.

Fees, Expenses, and Costs: A Closer Look

Understanding the Management Fee Structure

VDHG ETF charges an annual management fee of 0.27%, which is relatively low compared to actively managed funds. This fee covers the costs associated with managing the ETF, including portfolio construction, rebalancing, and administrative expenses.

The Impact of Fees on Investment Returns

While VDHG’s management fee may seem minimal, it can have a significant impact on investment returns over the long term due to the compounding effect. By keeping fees low, VDHG aims to maximise the potential for long-term wealth accumulation, as more of the investment returns are retained by the investor.

Risk Assessment: Evaluating VDHG’s Market Position

The Risk/Return Trade-off

As a high-growth ETF, VDHG carries a higher level of risk compared to more conservative investment options. However, this higher risk is accompanied by the potential for higher returns over the long term. Investors should carefully consider their risk tolerance and investment time horizon before investing in VDHG.

VDHG’s Risk Profile Compared to Similar ETFs

VDHG’s risk profile is similar to other high-growth ETFs in the market, with a suggested investment timeframe of 7 years or more. However, its diversification across multiple asset classes and its passive investment approach may provide a degree of risk mitigation compared to more concentrated or actively managed funds.

Distribution and Dividend Analysis

Dividend Yield and Payout Frequency

VDHG does not have a targeted dividend yield, as its primary objective is capital growth. However, the ETF does distribute income from its underlying holdings on a quarterly basis. These distributions can consist of dividends, interest, and any realised capital gains from the funds it holds.

Reinvestment Options and Tax Implications

Investors have the option to reinvest VDHG’s distributions back into the ETF through a distribution reinvestment plan. This can help enhance the compounding effect of returns over time. It’s important to note that distributions from VDHG may have tax implications, as they can include different components like income, capital gains, and tax credits, which need to be accounted for in your annual tax return.

Why Choose VDHG? Investor Suitability and Advice

VDHG Ideal Investor Profile

VDHG is suitable for investors with a high tolerance for risk who are seeking long-term capital growth. Its diversified portfolio and passive investment approach make it an attractive option for those who want exposure to multiple asset classes without the complexity of managing individual investments.

Making VDHG Work in Your Investment Portfolio

For investors looking to incorporate VDHG into their portfolio, it’s essential to consider their overall asset allocation and investment goals. VDHG can serve as a core holding for long-term growth, complemented by other investments based on an investor’s risk profile and investment horizon.

Conclusion: Is VDHG ETF the Right Choice for You?

The Vanguard Diversified High Growth Index ETF (VDHG) offers a compelling investment solution for novice and experienced investors alike. Its diversified portfolio, low-cost structure, and passive investment approach make it a suitable choice for those seeking long-term capital growth. However, investors should carefully evaluate their risk tolerance and investment objectives before investing in VDHG.

Future Outlook and How to Get Started with VDHG

As markets continue to evolve, VDHG’s diversification and strategic asset allocation position it well to navigate changing conditions. For those interested in investing in VDHG, the Vanguard Personal Investor Account provides a straightforward platform to get started, with a minimum investment of $500. Alternatively, investors can explore other online brokers or seek professional financial advice to determine if VDHG aligns with their investment strategy.

FAQs about Vanguard Diversified High Growth Index ETF (VDHG)

What is VDHG ETF ?

VDHG stands for Vanguard Diversified High Growth Index ETF. It’s a managed fund designed to offer investors a comprehensive, diversified portfolio by investing in a mix of asset classes primarily focused on growth assets. Its goal is to provide long-term capital growth with a diversification level aimed at reducing risk.

Who should invest in VDHG ETF?

VDHG is ideal for investors looking for a high level of growth from their investment over the long term and who are comfortable with the higher level of risk associated with growth-oriented assets. It’s suited for those who prefer a hands-off investment approach, as it provides a diversified portfolio in a single ETF.

How diversified is VDHG ETF?

VDHG is highly diversified, investing across a broad range of asset classes, including Australian and international equities, bonds, and real estate. Its strategic asset allocation is approximately 90% in growth assets and 10% in income assets, encompassing over 10,000 individual securities.

What are the fees associated with VDHG ETF?

VDHG has a management cost of 0.27% per annum. This fee is lower than many other investment options, reflecting Vanguard’s commitment to providing high-value, low-cost investment solutions. There are no performance fees or advisor commissions associated with VDHG.

How does VDHG ETF manage risk?

VDHG manages risk through extensive diversification across different asset classes and geographic regions. This approach helps to spread risk and reduce the impact of any single investment’s poor performance on the overall portfolio. However, it’s important to remember that all investments carry some level of risk, including the potential loss of principal.

Can I earn dividends from VDHG ETF?

Yes, VDHG pays dividends. The frequency of dividend payments is typically quarterly. Dividends can be reinvested through Vanguard’s Distribution Reinvestment Plan (DRP) or paid directly into your nominated bank account.

How can I invest in VDHG ETF?

You can invest in VDHG by purchasing units through a brokerage account, just like you would buy shares of a company on the stock exchange. VDHG is listed on the Australian Securities Exchange (ASX) under the ticker symbol VDHG.

Is VDHG ETF suitable for short-term investing?

Given its focus on long-term capital growth and its strategic allocation towards growth assets, VDHG is best suited for investors with a long-term investment horizon. Short-term investors may find the volatility associated with growth assets uncomfortable.

How has VDHG ETF performed historically?

VDHG aims for long-term capital growth and has shown resilience and growth since its inception. However, past performance is not a reliable indicator of future performance. Investors should review the most current performance data before making an investment decision.

Where can I find more information about VDHG ETF?

For the most detailed and current information about VDHG, visit the official Vanguard Australia website. It offers comprehensive resources, including product disclosure statements, fact sheets, performance history, and detailed information about the fund’s investment strategy and holdings.

Explore other ETF options in our Shares & ETFs section. Find a wide range of ETFs to suit your investment preferences and goals. You can also check our property investment articles for more opportunities.

References

| Website Name | Description | URL |

|---|---|---|

| Australian Securities Exchange (ASX) | Official site for Australian stock market news, including details on ETFs like VHY. | asx.com.au |

| Vanguard Australia | The issuer of VHY ETF, providing detailed fund information, performance, and insights. | vanguard.com.au |

| Morningstar Australia | Offers investment research and analysis, including ratings and reviews on various ETFs. | morningstar.com.au |

| Financial Review | A leading source for financial and investment news in Australia, including ETF analysis. | afr.com |

| InvestSMART | Provides investment advice, tools, and services, including ETF comparisons and analyses. | investsmart.com.au |

Share Your Thoughts and Experiences

Share your thoughts, questions, and insights in the comments below.

We’d also love to hear your feedback on this article. Did you find it informative and engaging? Are there any additional topics or aspects of the ETF you’d like us to cover? Your input helps us create even better content for the Aussie investing community.

Remember, investing involves risks, and it’s crucial to conduct your own research and seek professional advice before making any investment decisions. The ETF may or may not be the right fit for your specific circumstances, but we hope this review has provided you with a comprehensive understanding of this popular Australian ETF.

Happy investing, and stay tuned for more insightful content from our team!

Important Disclaimer: Not a Licensed Financial Advisor

The information and insights provided in this document are intended solely for educational and informational purposes. It’s imperative to understand that I am not a licensed financial advisor, tax expert, or investment strategist. The contents herein are crafted to offer a general overview and should not be construed as personalized financial advice.

Affiliate Disclosure: Some of the links on this blog may be affiliate links. This means if you click on the link and purchase a product or service, I may receive a commission at no additional cost to you. I only recommend products or services that I believe in and that may be helpful to my readers.

Before making any financial decisions or embarking on investment ventures, it’s crucial to consult with a professional financial advisor or a certified tax consultant who is well-equipped to understand your unique financial landscape. Engaging with a licensed professional ensures that the advice you receive is tailored to your specific financial goals, risk tolerance, and tax obligations, adhering to the compliance and guidelines established by regulatory authorities, including the Australian Taxation Office (ATO) and other relevant bodies.

Financial markets are complex and dynamic and involve various degrees of risk. Therefore, thorough due diligence and professional guidance are essential to navigate these waters effectively. This content does not represent the opinions or endorsements of any financial institutions or regulatory agencies. Remember, the responsibility for financial decisions lies with the individual, and seeking qualified advice is the best step towards informed decision-making and achieving financial objectives.